If we consider a startup to be a plant and the entrepreneur to be a farmer, the idea is the seed.

Now, if a new farmer must undertake the venture, he’d require external funding to –

- Get the seed and test it before sowing

- Get the land ready and sow it

- Nurture the sapling

- Nurture the plant

Convert this process to the startup perspective, and you’ll get the startup funding rounds –

- Pre-Seed Funding Round

- Seed Funding Round

- Series A and Series B

- Series C

Contrary to what most new entrepreneurs think, this funding process doesn’t differ for different startups. It’s just that a few (existing) entrepreneurs can take shortcuts because of their type of idea, financial backing, brand, network, and contacts.

But if you’re a new entrepreneur who must take the long route, fret not. Use this article as a field guide to help navigate the new landscape of startup fundraising.

But before we get started with explaining the startup funding rounds, you need to understand the following technical keywords and keyphrases we’ll use –

- Equity: Equity is the degree of ownership in the business. It is usually denoted in the form of a percentage.

- Ticket Size: It is the amount of money invested in a business.

- Angel Investor: A high net-worth individual who provides financial backing to small startups and entrepreneurs.

- Venture Capitalists: A professional investor (usually a firm) that funds startups and business ventures showing high growth potential in exchange for an equity stake.

- Equity Financing: It’s a method of raising funds by selling the business’ stock to investors.

- Debt Financing: It’s a method of raising funds by selling debt instruments to investors, making them the creditors to the business who receive both the principal and agreed on interest on the debt.

- Convertible Note: A short-term debt that converts into equity at a later date after a conversion event occurs (usually when the startup raises capital in the next fundraising round), and the startup is mature enough to be valued.

- SAFE (Simple Agreement for Future Equity): A financing contract between the investor and the business that gives the investor a right to receive equity in the business on certain triggering events (like the next fundraising round or the sale of the business). SAFE isn’t debt or equity.

Pre-Seed Funding Round

- The startup is at a nascent stage. Operations are getting off the ground.

- The startup has found the market opportunity

- No real customer traction.

- Test products are developed to validate assumptions

- Ticket size is very small ($50,000 – $200,000 for a 5% – 10% equity stake)

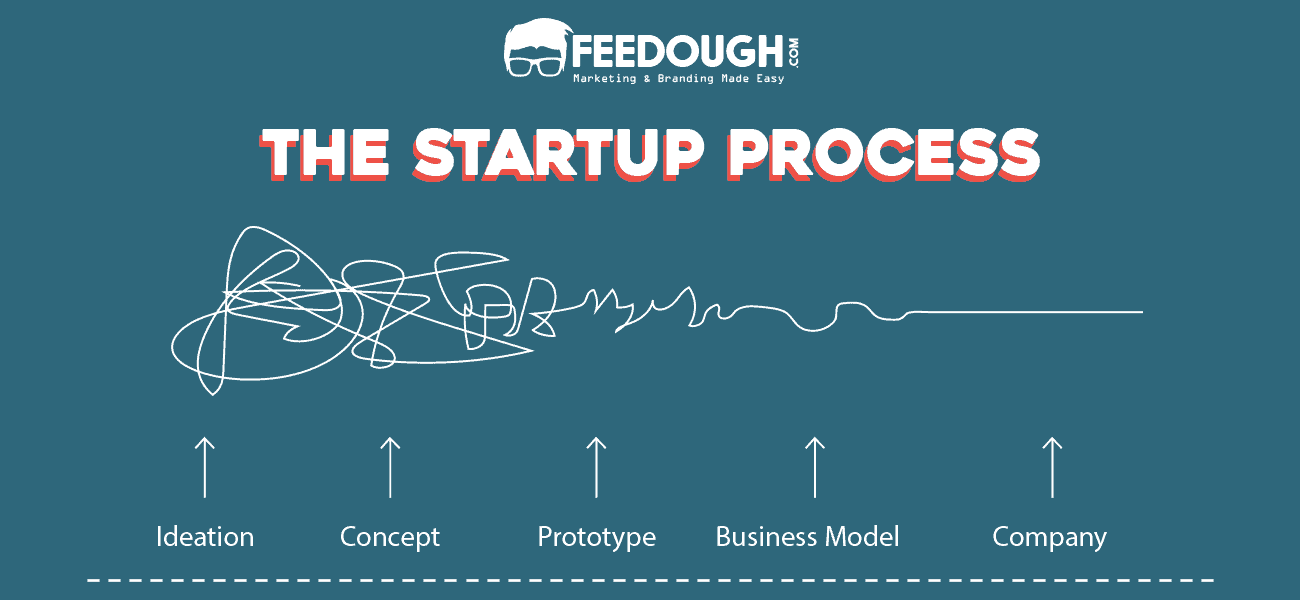

A pre-seed stage is when the entrepreneur is in the process to convert the idea into an actual business. To do so, he often requires some tests to validate his/her offering’s problem-solution fit and the viability of the business model and business plan.

Depending on the type of product, this sometimes requires him to look for external funding aid. This is where pre-seed funding comes into the picture.

What Is Pre-Seed Funding?

Pre-seed funding, also called pre-seed capital or pre-seed money, is the small investment offered by an investor usually in return for equity or debt and interest repayment, to a startup owner to help him get his/her business operations off the ground.

In simple terms, it is the investment required by the startup owner to –

- Validate the problem-solution fit

- Get some real customer traction

- Develop the MVP and the actual offering

- Get key employees and partners on board

- Get the business started and begin operations

Sources Of Pre-Seed Funds

Usually, a lot of entrepreneurs are lucky enough either to bootstrap their startup or to raise pre-seed from their family, friends, and some fools. Some also get some high net-worth partners on board and share the equity with them to get the business started.

Besides these sources, here are some other common and uncommon sources of pre-seed capital –

- Debt Financing: Taking personal loans from the bank and other financial institutions.

- Pitch Competitions: Participating in pitch competitions where you have a limited time to present your business idea in front of an audience and a jury.

- Startup Incubators: Taking the help of (government and private) collaborative programs designed to help startups develop during its initial in return for some equity or interest on the debt.

- Government Grants & Business Grants: Applying for numerous industry-based and country-based business grants like SBIR, 4pt0, ActivityHero Business Grant etc., set up for early-stage startups and leaders.

- P2P Lending: Using an online P2P lending platform to get loans from several individual lenders, eliminating the financial institution as the middleman.

- Pre-Seed Angel Investors: Scoring angel funds from angel investors who specialize in investing in pre-seed startups.

- Pre-Seed Venture Capitalists: Scoring venture funds from venture capitalists who specialise in investing in pre-seed startups.

However, obtaining pre-seed funds from angel investors or venture capitalists is often considered to be unlikely as they usually invest in businesses with a validated problem-solution fit and a product-market fit with a well-defined business and revenue model.

Even if they invest, they do it in the form of debt, convertible notes, or SAFE.

Startup Valuation At The Time Of Pre-Seed Stage

Since there is no real traction during the pre-seed stage, most of the investors invest using predictions as the anchor to calculate their equity or invest in the form of debt, convertible notes, or SAFE.

Seed Funding Round

- The idea is converted into a business

- Key partners and employees are on board

- Customer traction has started

- Product development is still under process

- Ticket Size is comparatively small ($100,000 to $6 million)

A seed stage is when the idea is converted into a business, and the startup starts seeing real customer traction. The product might still not be developed during the seed stage, but the founders might have both – the proof of concept and the MVP validated in this stage.

What Is Seed Funding?

Seed funding, also called seed capital or seed money, is a considerably small investment offered by an investor, usually in return for equity or debt and interest repayment, to a startup owner to help him/her fulfil the initial growth requirements of his/her business.

It is considered to be the first official equity funding required by the startup owner to –

- Finance market research and product development

- Pay salaries and payments to key employees and partners

- Manufacturing products at scale

- Penetrating an existing market or creating a new market for the product

- Building a brand

- Growing the team

Sources Of Seed Funds

The seed round is also called the angel round because it’s dominated mostly by angel investors who invest in the startups in return for an equity, convertible note or SAFE. Other than them, here are some other sources of seed funds –

- Crowdfunding: Raising a small amount of money from a large number of people in return for equity, interest on the debt, or rewards to the investors.

- Corporate Seed Funds: Raising money from big brands like Google, Apple, FedEx, etc., in return for some equity or future partnership.

- Accelerators: Joining startup accelerators designed explicitly to help early-stage startups grow and reach their full potential. Startups need to apply to such accelerators, who then provide them with structured guidance and financing in return for some equity or fees.

- Venture Capitalists: Raising funds from specialized venture capital firms that fund startups and business ventures showing high growth potential in exchange for an equity stake.

Startup Valuation At The Time Of Seed Stage

Startup valuation at the time of the seed stage is similar to that during the pre-seed stage. However, some startups do succeed in getting their startups valued ($2 million to $20 million) by considering the following factors –

- Traction: Customer traction is a major factor which drives the valuation during the seed stage. This quantitative proof shows how the startup is taking off and what can be predicted in the future.

- Reputation: The founder’s reputation and image in the market play a great role in the startup valuation during the seed stage. Serial entrepreneurs enjoy an upper hand during seed-stage funding rounds.

- Prototype & MVP: The response to the prototype and MVP affect the valuation as they are considered to be predictable factors for future success.

- Pre-valuation Revenue: Revenues make it easier for investors to carry out the valuation. Revenues also assure them that the offering has a market and customers are willing to buy the offering.

- Industry: It is highly likely that an investor pays a premium to a startup operating in a booming industry compared to a startup operating in a dying industry.

Series A Funding Round

- Product is completed

- The user base is established

- Revenue and other KPIs are more consistent

- Ticket size is considerably big compared to the seed round ($15 – $20 million)

A successful seed stage results in an established customer base, increasing revenues, a growing team, and expanding market. This often requires the startup to raise more money, and that too at a big scale.

What Is Series A Funding?

Series A funding is the second official stage of the startup financing process and the first stage of venture capital financing, where an established startup company scores funding from one or more than one venture capital firm to set up mass production and increase revenue in return for startup equity.

Generally, more than one investor takes part in the Series A stage, with one leading the round with the most funding.

The startup raises this fund to –

- Develop a business model for long-term growth

- Cover the increasing costs until the startup becomes revenue financed

- Promote and carry out additional research and development projects

But according to CB Insights, only 46 percent of seed-funded companies raise another round. That is to say, a lot of companies fail after the seed round, which makes Series A round very risky and crucial for investors.

Sources Of Series A Funds

Irrespective of the industry, angel investors and venture capitalists are the primary sources of Series A funding. The equity offered (10% to 30% of the company) differs for different startups based on various factors, but the issuance of ordinary shares, redeemable shares, or preference shares structures the investment.

Startup Valuation At The Time Of Series A Stage

The average post-money valuation of a startup raising a Series A fund is $22 million however, it can range anywhere from $10 million to a few billion, based on –

- KPIs: The key performance indicators play an important role in evaluating a startup for its valuation. These include revenues, customers, repeated purchases, etc.

- Growth from the seed stage: Evaluating how much the startup has grown from the last time it took investment helps the investor negotiate the valuation of the startup.

- Offering evaluation: By the time of the Series A stage, the company collects enough data to answer questions like ‘does the offering satisfy market needs?’, ‘can the offering be replicated?’, ‘do customers come back for repeated purchases?’.

- Customer evaluation: The customer’s evaluation gives a good hint about the current position and the growth prospects of the startup. This makes the valuation easy.

- Competitor Analysis: While the presence of competitors means there’s a market for the startup’s offerings, the presence of a big player often makes the investors step back from investing in the startup.

- Industry: A startup in the booming industry receives a premium, while a startup in the dying industry witnesses a discount.

Once the funding round is complete, the company usually gets the working capital within six months to 18 months.

Series B Funding Round

- Product-market fit is validated

- The startup needs money to expand

- The customer base is growing at a reasonable rate

- The startup requires adding more team members on board to handle the increased customer base.

- Ticket size is big, ranging anywhere from $15 million to $900 million.

By the time a startup reaches the Series B stage, its product-market fit is validated, and the startup has started to expand within its market. This funding round is considered to be a safe round for investors as startups reaching this round will most probably grow as compared to startups at the Series A round.

What Is Series B Funding?

Series B funding is the third official stage of the startup financing process and the second stage of venture capital financing, where a growing established startup company scores funding from venture capital firms to expand its operations in return for startup equity.

Series B funding is required to

- Scale up the startup operations

- Hire top-performing employees

- Tackle growing competition

Sources Of Series B Funds

Just like the Series A funding round, the Series B funding round involves more than one investor (usually venture capitalists and private equity funds), which is led by one investor with the most investment which acts as an anchor.

Startup Valuation At The Time Of Series B Stage

Unlike other rounds, startups raise series B funding at different stages and for different reasons. This increases the range of the investment raised and the startup valuation. The post-money valuation of a startup raising series B investment is anywhere from $30 million to a billion.

Series C Funding Round

- The company is already a success

- The business model is profitable

- Ticket size is huge ($30 million to a few billion)

Startups with exponential growth plans go for a series C round to get funding to grow and expand.

What Is Series C Funding?

Series C funding is the fourth official stage of the startup financing process and the third stage of venture capital financing, where a successful startup company scores funding from venture capital firms to grow and expand in return for startup equity.

Usually, this is the last private equity fund a startup raises. It is done to –

- Expand into new markets,

- Acquire new businesses, and

- Develop new offerings.

Sources Of Series C Funds

Since the startup is already a success when it reaches the Series C stage, and there is minimal risk involved, big investors like late-stage venture capitalists, private equity and investment bankers show up. Sometimes, the money is even raised from hedge funds.

Startup Valuation At The Time Of Series C Stage

The money invested during the Series C stage is huge, resulting in a startup valuation to be over a hundred million or over a billion.

Series D, E, & F

Companies going ahead of the series C stage often choose so because of the following two reasons –

- New opportunities: The company has discovered a new opportunity and wants to grab it before going into an IPO.

- Not-at-par performance: The company didn’t fulfil the expectations after the Series C round and requires more funds to do so. This may even result in raising funds at a valuation lower than what was decided during the previous rounds.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on startup funding stages in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.