Generally, your startup will not be profitable during its early stages. By not profitable, I mean that you’ll spend more than you’ll earn.

This is usually the most common reason why your startup might require external funding.

But the investors at such an early stage often look for a metric to understand the cash outflow rate and how much time it will take for your startup to use all of the invested money.

This is when the concept of burn rate and startup runway comes in.

What Is Burn Rate?

Burn rate, or cash burn rate, is the rate at which the business uses up its cash reserves or cash balance.

It is essentially a measure of the net-negative cash flow – how much money your startup spends and how quickly it spends it.

Usually, burn rate is quoted in terms of cash outflow per month. Hence, its better definition would be the actual amount of cash a business spends in one month.

For example, if your business has a burn rate of $10,000, it means it spends $10,000 per month.

While this burn rate is generally expressed in months, it can also be expressed in terms of days, weeks, and years, depending upon your requirements.

Types Of Burn Rate

Burn rate is categorised into two types: gross and net.

The gross burn rate is the total amount of cash the business spends in a month.

The net burn rate, on the other hand, is the net-negative cash flow after taking into account the revenue, if generated.

For example, if your business spends $20,000 per month but also earns a revenue of $5,000 per month, its gross-burn rate is $20,000, but the net-burn rate is $15,000.

How To Calculate Burn Rate?

Calculating startup burn rate is straightforward. It’s the total amount of cash decreased in one month. It doesn’t include outstanding obligations or money that’s on its way. It’s just your business’s negative cash flow.

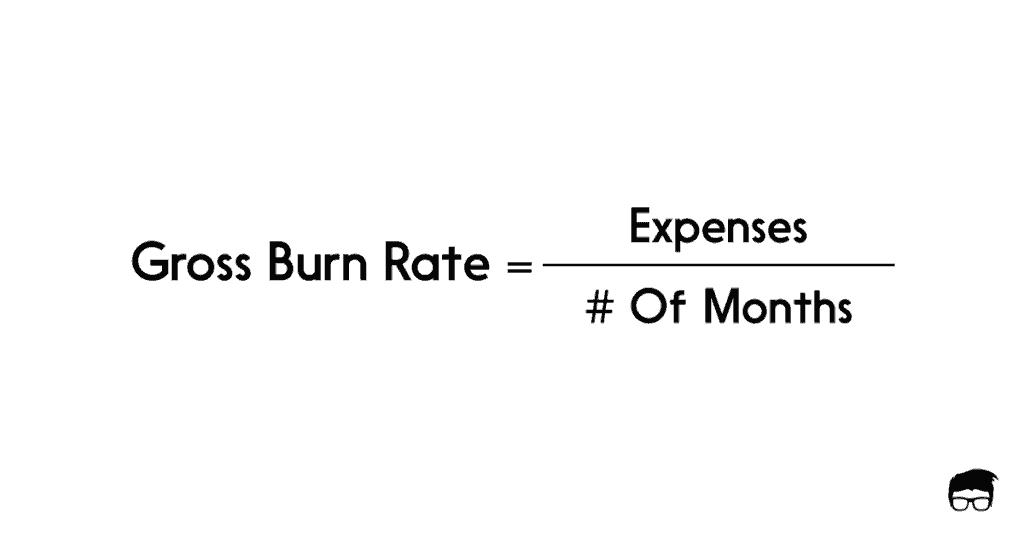

Gross Burn Rate Formula

You calculate gross burn rate by dividing the total expenses by the number of months. For example, if the total expense for three months is $90,000, the gross monthly burn rate would be 90,000/3, which comes out to be $30,000.

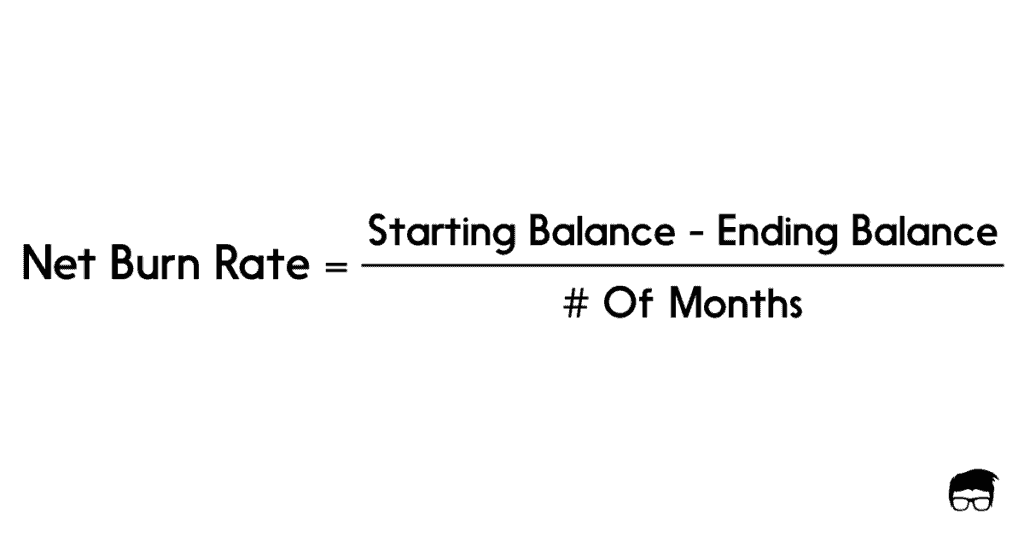

Net Burn Rate Formula

You calculate the net burn rate by dividing the net cash outflow by the number of moths. The net cash outflow takes into account the revenue generated during the specified period. It is calculated by subtracting the starting balance of the period by the ending balance of that period (starting balance + revenue earned – expenditures). For example, if your startup received a funding of $60,000, earned a revenue of $10,000, but incurred an expenditure of $40,000 in 3 months, its net cash burn rate would be (60,000 + 10,000 – 40,000)/3, which comes out to be $10,000.

What Is Startup Runway?

Startup runway, also called runway or cash runway, is the amount of time a startup can operate at a loss before running out of money.

In simple terms, it refers to the period after which your startup can’t survive in the market if the income and expenses remain constant.

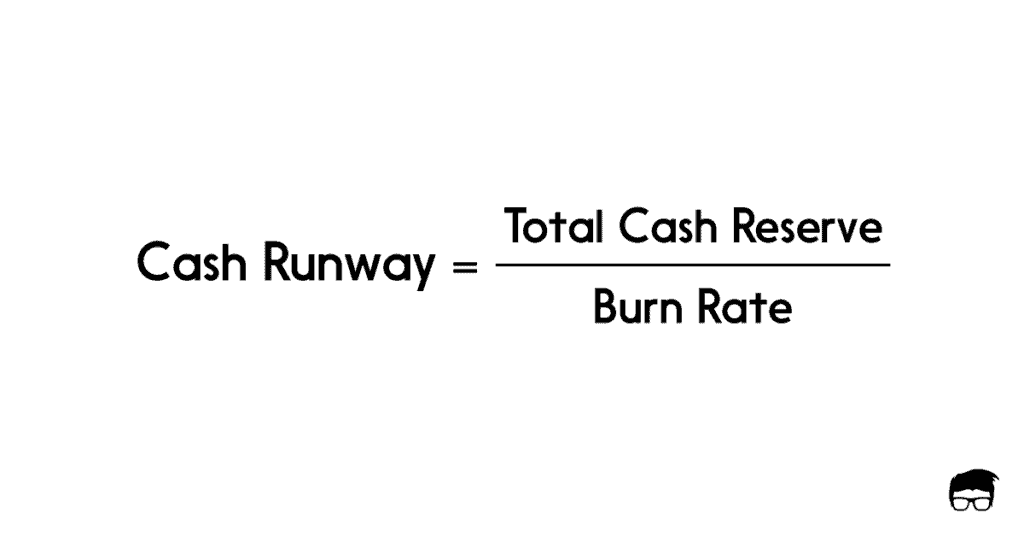

How To Calculate Cash Runway?

Suppose you have a startup that got an investment of $100,000 and doesn’t have money otherwise, is running at a burn rate of $20,000 a month. It has five months before it runs out of cash and gets itself in serious trouble.

We reached this figure by using this simple cash runway formula: Total Cash Reserve / Burn Rate.

Total cash reserve is the total amount of money that your business can spend. It is the sum of investment and total revenue.

Why Is Calculating Burn Rate And Cash Runway Important?

According to CBInsights, cash crunch is the second leading cause of startup failure. Calculating the burn rate helps you answer when and why will your startup run out of cash, and how can you prevent from failing due to the same. Besides this, calculating burn rate and cash runway is essential as it helps to –

- Calculate the time your business has before it should be profitable or get another round of funding.

- Decide on whether to prioritise fundraising at present or at a later stage.

- Develop a viable budget.

- Develop strategies to cut down on expenses or increase revenue.

- Get realistic data of when your business can become profitable.

- Make sure whether your business is moving in the right direction or not.

Moreover, investors always consider burn rate to be an essential factor before investing in a startup.

What Is A Good Burn Rate And Cash Runway?

For most startups, a cash runway period of 12-18 months is considered to be good.

While most experts prefer the runway period to be around 18 months irrespective of the funding round, CBInsights has estimated the median time lapse between funding rounds –

- 12 months for Seed to Series A

- 15 months for Series A to Series B

Hence, a good burn rate is one that can help your startup stay afloat for 12 to 18 months without requiring external funding in between.

How To Reduce Burn Rate?

A low burn rate suggests that your startup is growing and might sustain for an extended period.

A higher burn rate, however, usually suggests that the cash supply is depleting faster than it should, which indicates that the startup is at a higher likelihood of entering financial distress.

Here are the ways you can use to reduce your business’ burn rate.

- Increase The Revenue: Revenue adds to the cash reserve and reduces the net cash burn rate.

- Cut Off Unprofitable Revenue Streams: You can ditch unprofitable or loss-making revenue streams and direct such resources towards the streams that can benefit your startup.

- Reduce Payroll Expenses: Smart hiring always reduces the expenditure of your business. The process involves deciding the positions beforehand, hiring multitaskers, and keeping the organisational structure flat.

- Reduce Or Defer Other Expenses: Reducing the expenditure and deferring the payments helps keep the cash flow positive or less negative for some time.

- Cut Off Unnecessary Costs: Unnecessary costs that don’t help your business in core activities can be reduced to reduce the burn rate.

- Encourage Cash Sales: Cash sales increases the cash inflow and reduces the cash burn rate.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on burn rate and cash runway in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.