What started as a simple photo-sharing platform has turned into a social media giant that’s changing how we communicate, consume content, and do business online.

477 million people use Snapchat every single day, creating 4.75 billion snaps. That’s not just impressive, it’s a goldmine of insights for anyone trying to understand modern digital behaviour.

Whether you’re a marketer planning your next campaign, a business owner exploring new platforms, or a researcher tracking social media trends, these numbers tell a story you need to hear.

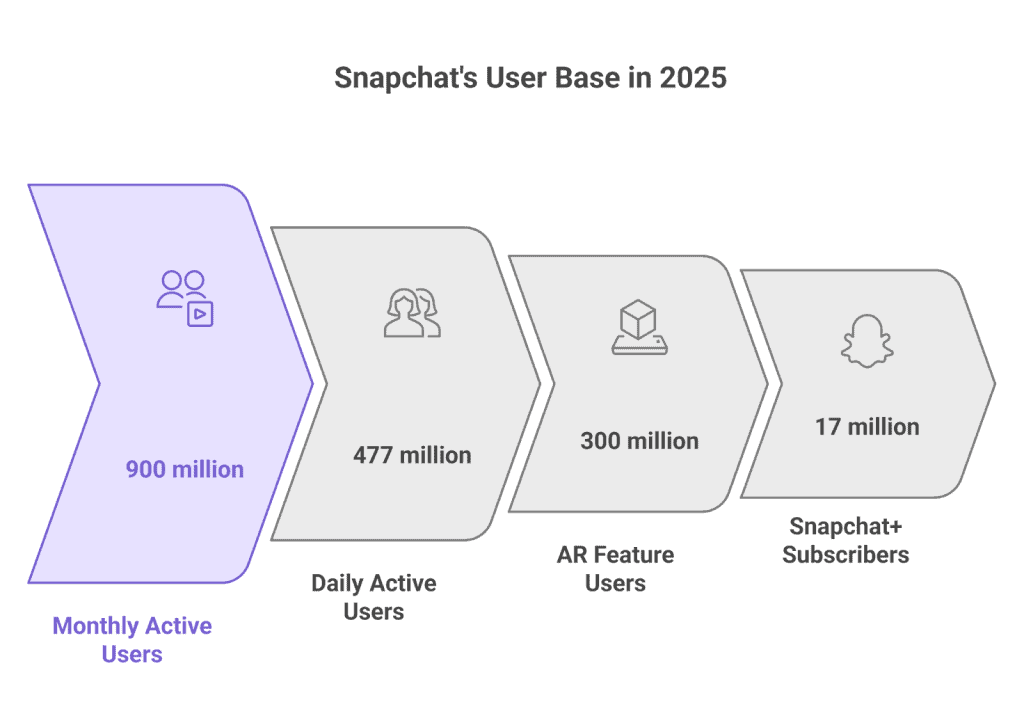

Key Statistics

- 477 million daily active users – Snapchat’s daily user base continues growing steadily

- 900 million monthly active users – The platform’s total monthly reach shows its massive global presence

- $1.51 billion quarterly revenue – Snapchat’s Q3 2025 earnings hit another record high

- $1.32 billion from advertising – Ad revenue makes up the lion’s share of income

- 17 million Snapchat+ subscribers – The premium service shows strong adoption

- 300 million daily AR users – Augmented reality engagement demonstrates the platform’s tech leadership

- 4.75 billion Snaps daily – Users generate massive amounts of content daily

- 75% of Gen Z and Millennials – Regular users from younger demographics

Snapchat is clearly thriving, balancing massive scale with intimate, personal communication that keeps users coming back.

User Base and Growth Statistics

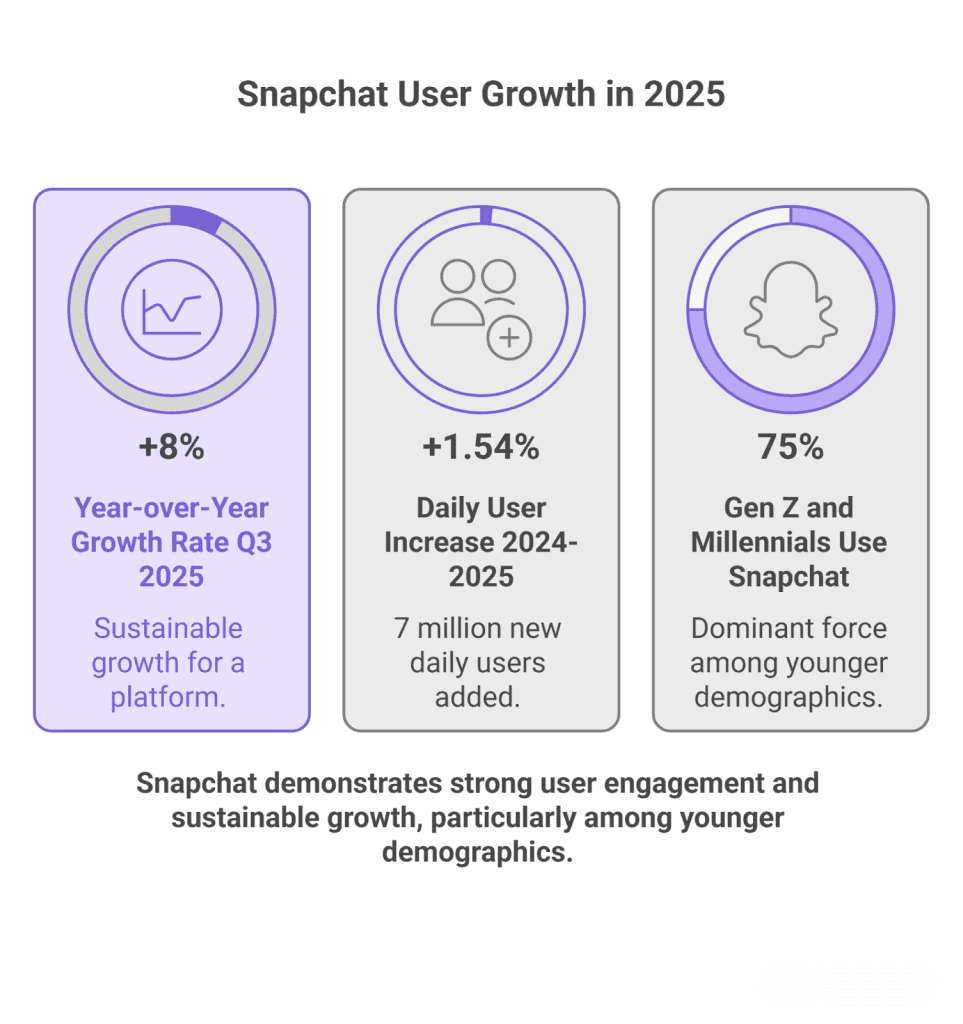

Snapchat’s user growth in 2025 shows steady momentum rather than explosive expansion. The platform has managed to maintain consistent growth patterns that show its staying power in a competitive social media landscape.

Current User Metrics:

- Daily Active Users: 477 million (Q3 2025, up from 469 million in Q2)

- Monthly Active Users: 900 million users globally

- Year-over-Year Growth: 8% increase in Q3 2025

- Daily Growth Rate: Approximately 7 million new users throughout 2025

- Growth from 2024: 1.54% increase (from 453 million to 460 million)

Snapchat shows steady, sustainable growth. The platform isn’t experiencing explosive user acquisition like a brand-new app, but it’s maintaining momentum that suggests strong user retention and consistent appeal to new audiences.

Financial Performance and Revenue Statistics

You can have millions of users, but if you can’t turn that audience into sustainable revenue, you’re just running an expensive social experiment. Snapchat? They’ve figured out the money game.

According to Snap’s Q3 2025 earnings, the platform pulled in $1.51 billion in total revenue. That’s a solid 10% jump from the same quarter last year. But let’s break this down because the details reveal something fascinating about how modern social platforms actually make money.

Revenue Breakdown: Where the Money Comes From

Snapchat’s revenue story has two main characters, and they’re performing very differently:

- Advertising Revenue: $1.32 billion (5% year-over-year growth)

- Other Revenue: $190 million (54% year-over-year increase)

That “other revenue” category? It’s mostly Snapchat+, their premium subscription service. And here’s what caught our attention. While advertising growth is steady at 5%, that subscription revenue is absolutely exploding at 54% growth.

What this means for you: Snapchat isn’t putting all their eggs in the advertising basket anymore. They’re building multiple revenue streams, which makes the platform way more stable when economic conditions get rocky.

The Subscription Success Story

Let’s talk about those 17 million Snapchat+ subscribers, up 35% from last year. That might not sound huge compared to their 443 million total users, but here’s the thing: those subscribers represent incredibly valuable, predictable revenue.

Think about it this way. If you’re paying for Snapchat+, you’re deeply engaged with the platform. You’re not just scrolling through; you’re invested enough to actually pay for extra features. These users typically spend more time on the app, engage more with content, and are way less likely to jump ship to competitors.

Content Creation and AR Engagement Statistics

Here’s what makes Snapchat different from every other social platform: people don’t just scroll and like. They create.

Content and AR Metrics:

- Daily Snaps Created: 4.75 billion (roughly 55,000 snaps per second)

- Daily AR Users: 300 million people interact with AR lenses and filters

- AR User Percentage: Two-thirds of Snapchat’s daily active users

- Camera-First Design: The camera opens first, not the feed

Snapchat’s audience behaviour is distinct from other platforms: they’re not passive consumers. They’re active creators who want to interact, experiment, and share.

When someone opens Snapchat, they’re not thinking, “Let me see what’s happening.” They’re thinking, “Let me make something.” That mindset shift changes everything for brands trying to reach these users.

Plus, those AR interactions aren’t just fun and games. Users who engage with AR lenses show significantly higher purchase intent and brand recall. You’re reaching people when they’re most engaged and creative, not when they’re mindlessly scrolling.

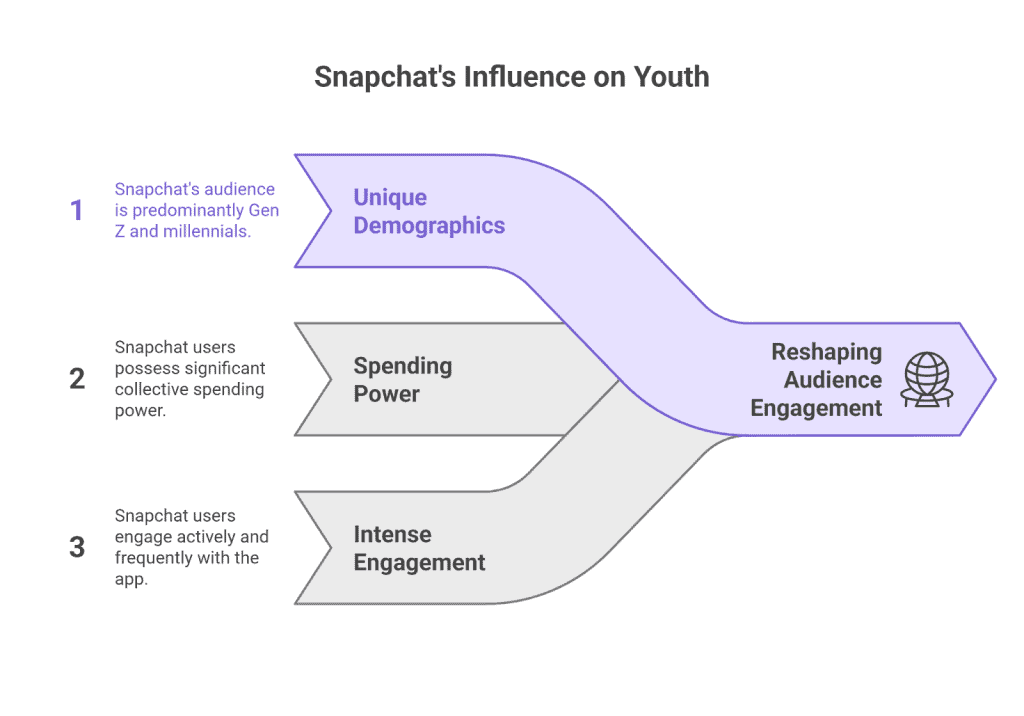

User Demographics and Behaviour Patterns

Snapchat has carved out a unique position as the digital playground for Gen Z and millennials, creating behaviour patterns that could completely reshape how you think about reaching younger audiences.

Key Demographics:

- Primary Age Range: Over half of users are aged 13-24

- Combined Spending Power: $5 trillion (Gen Z and Millennials together)

- Daily Opens: Users open Snapchat 30+ times per day

- Time Spent: Average of 32 minutes daily

- Feature Engagement: 92% of users regularly use both Chat and Stories

- Addressable Ad Audience: 709 million users

What really sets Snapchat apart is how intensely users engage with the platform. The average Snapchatter isn’t just casually checking in once or twice a day—they’re actively engaged throughout the day.

For businesses trying to reach this demographic, the patterns are clear. You’re not dealing with distracted users who might glance at your content between other activities. Snapchat users are present, engaged, and checking the app throughout their day.

The frequency of use also suggests something about user intent. When someone opens an app 30+ times daily, they’re not just killing time. They’re checking in with friends, staying updated on trends, and looking for entertainment.

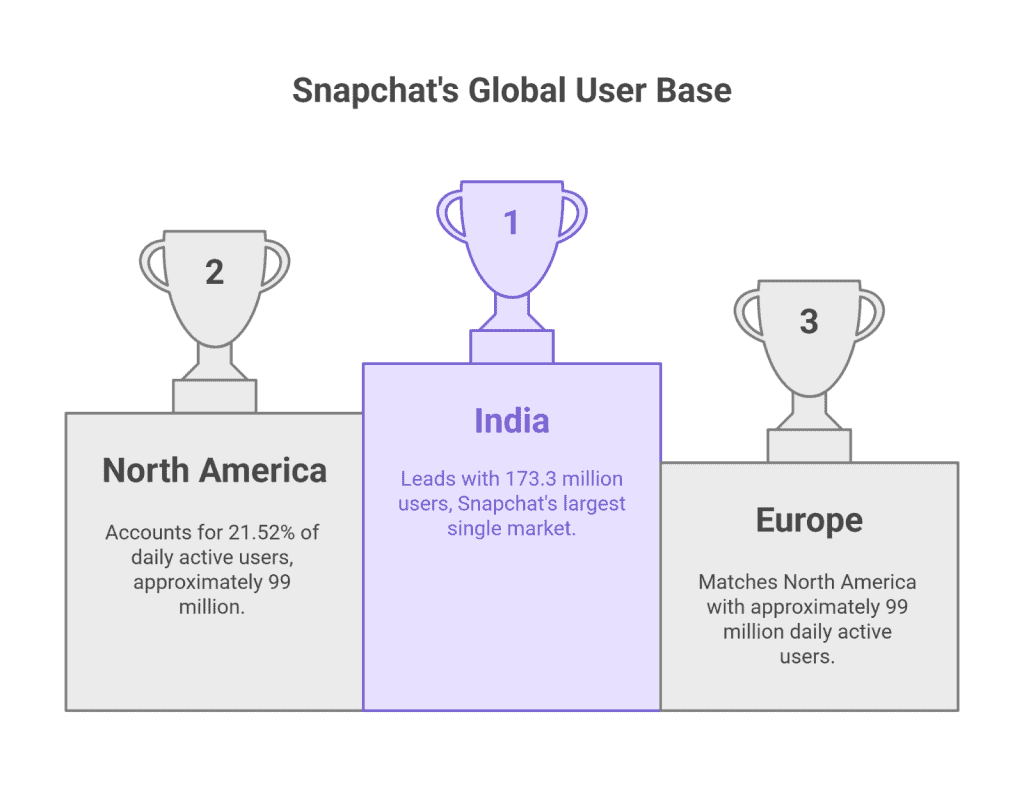

Geographic Distribution and Regional Markets

When you first think about Snapchat’s global reach, you might picture it as predominantly American-centric. The reality tells a different story entirely.

Regional Breakdown:

- India: 173.3 million users (largest single market)

- North America: 99 million daily active users (21.52%)

- Europe: 99 million daily active users

- Rest of World: 262 million users

India actually leads the pack with 173.3 million users, making it Snapchat’s largest single market by volume. The platform that started as a California college experiment now finds its biggest audience halfway around the world.

The geographic split is revealing. North America might represent Snapchat’s most mature market, higher engagement rates, premium advertising pounds, and established user behaviours. But the platform’s future clearly lies in international expansion, especially across Asia-Pacific and emerging markets.

For businesses, this geographic distribution creates some fascinating opportunities. If you’re targeting Gen Z globally, you can’t ignore markets like India, where Snapchat usage continues climbing. But if you’re after premium spending power, North American and European users likely offer higher conversion rates.

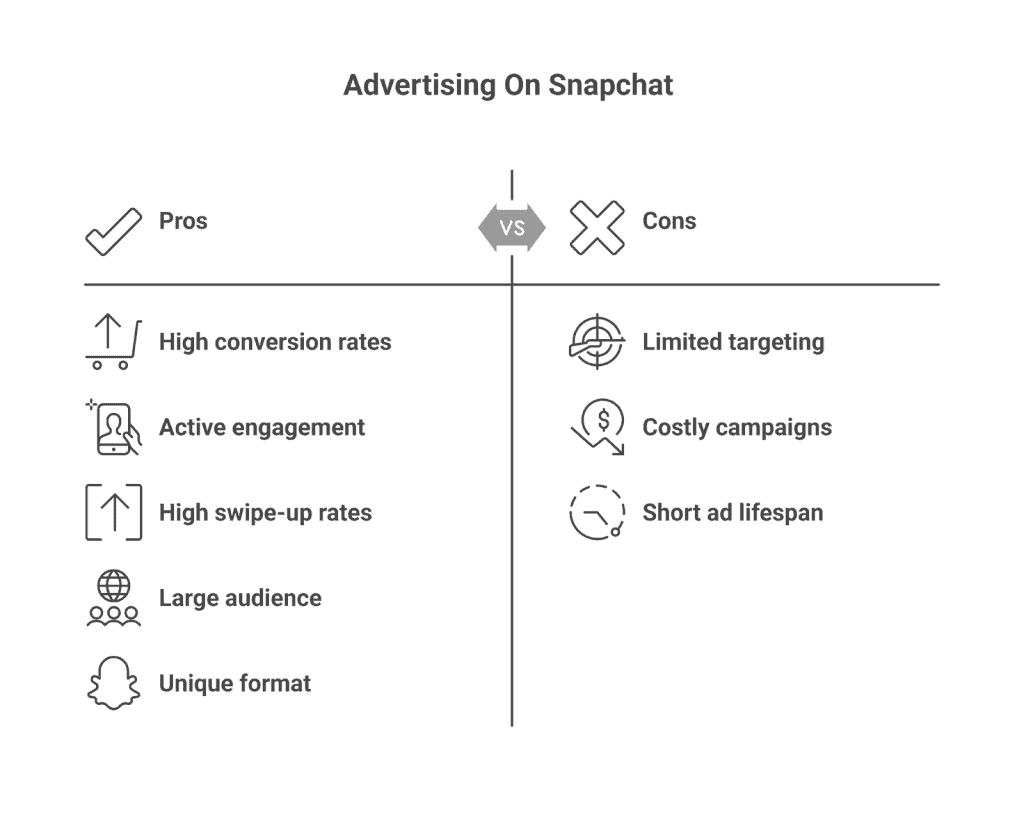

Advertising Effectiveness and Business Impact

While Snapchat’s massive user base looks impressive on paper, the real question for marketers is simple: does it actually drive sales?

Advertising Performance:

- Purchase Rate: 63% of users have made a purchase after seeing something on Snapchat

- Swipe-Up Rates: 5x higher than other social platforms

- Addressable Ad Audience: 709 million people

- Daily AR Users: 300 million (for AR try-on experiences)

The answer might surprise you. According to AWISEE research, 63% of users have made a purchase after seeing something on Snapchat. That’s not just engagement; that’s actual buying behavior.

Here’s what makes Snapchat advertising different from other platforms. The app’s design forces users to actively engage with content. You can’t passively scroll like on Facebook or Instagram. This active participation translates into higher conversion rates across the board.

Those 300 million daily AR users aren’t just playing with filters; they’re experiencing products before buying them. AR try-on experiences let customers test makeup, glasses, or home decor without leaving their couch. This creates a shopping experience other platforms simply can’t match.

The platform’s ephemeral nature also creates urgency that traditional advertising lacks. When users know content disappears, they’re more likely to act immediately rather than bookmark it for later.

Final Thoughts

With 477 million daily active users generating 4.75 billion snaps per day and opening the app over 30 times daily, the platform has achieved something many competitors struggle with: genuine user engagement that translates into business results.

The $1.51 billion in revenue, driven by advertising rates that outperform industry standards by 5x, proves that brands see real value in Snapchat’s young, purchase-ready audience.

What makes these statistics particularly compelling is the consistency across different metrics. From the 63% of Gen Z users who make purchases based on

Snapchat has built a platform where users don’t just scroll, they participate, create, and buy. As the platform continues its steady 8% year-over-year growth and expands its global footprint, particularly in emerging markets like India, Snapchat appears well-positioned to maintain its role as the go-to platform for brands targeting younger demographics who actually convert.

An ardent reader, full-time writer and a lover of all things purple. Riya is an entrepreneurial spirit, making her way in the start-up industry through her expressive writing. When not working, you can find her jamming to music, watching period films, eating sushi, or petting cats.