As a budding entrepreneur, you will encounter few domains as confusing as venture capital. You must have had to shed several false notions by now but this is where it gets intense.

Venture Capital is the early-stage funding that investors provide to startups with high-growth potential in exchange for equity. These investors also provide other resources like network, guidance, and expertise which makes venture funding one of the most sought-after forms of investment.

Generally, budding entrepreneurs think they can talk to a venture capitalist and convince them to fund their business out of their pockets, but that’s not the case. A venture capitalist is an individual who partners with other individuals and organisations to pool money and invest it in growing businesses like yours. Venture capitalists are members of associations called venture capital firms; they work as a part of these firms. These people have a huge appetite for risk and are ready to invest in growing businesses that may or may not turn out to be profitable.

The rule of thumb says that a venture capitalist looks at 100 companies, funds 10 of them, and sees only 1 succeed. So, they are always on the lookout for that one company that generates enough returns to cover all their costs and this is why they grill you during fundraising.

It’s difficult to bag venture funding. The whole process takes a lot of research, ideation, and execution. Moreover, even after a VC has agreed to fund you, there are a lot of procedures, technicalities, and formalities that are to be done the right way. One small mistake and you see your business fail. Therefore, it is essential to understand the functioning and structure of a VC firm.

Read on to learn more.

Structure Of A Venture Capital Firm

Usually, two or more people come together to establish a venture capital firm. They are generally experienced individuals who have been entrepreneurs, investors, consultants, etc. and have a good knowledge of various industries.

These people don’t invest completely out of their own pockets but bring in outside investors. They are high net-worth individuals and institutional investors like insurance companies, university endowments, pension funds, and large corporates.

Senior members of the VC firm raise money just like founders do for their startups. They approach these potential investors, present their pitch decks, attend countless meetings, and try to convince them to put money in the firm.

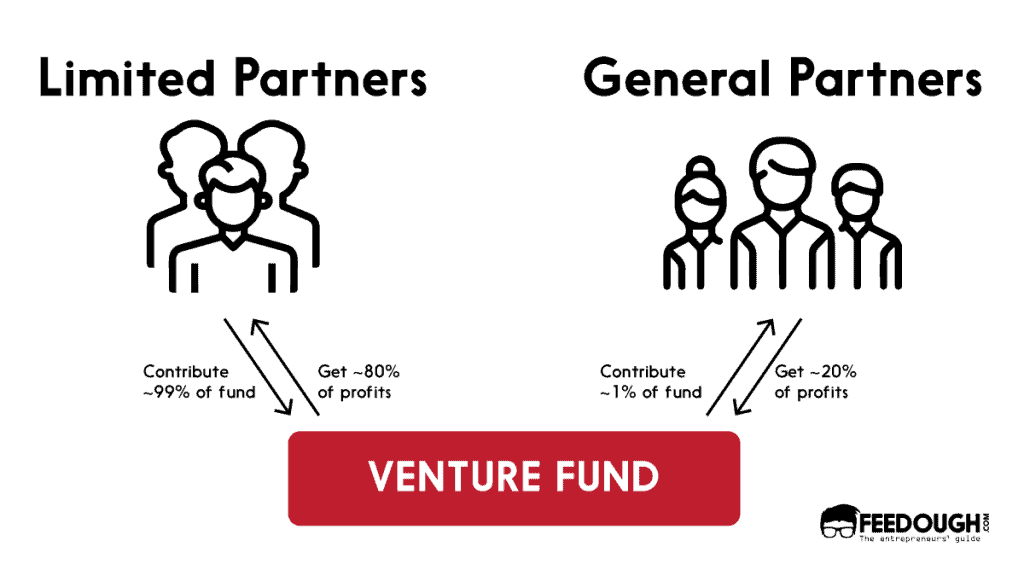

All the money they get from the outside goes into a venture fund and forms 99% of it. Only 1% is contributed by the VC firm. Venture capitalists can also take small loans if required.

Now that the venture capital firm and investors have pooled money, they enter into a limited partnership agreement (LPA), that is, a contract that establishes a limited partnership.

Limited partnership (LP) is a legal association with two kinds of shareholders:

- Limited Partners (LPs): Here, outside investors are limited partners. Although they play a major role in the deal, they do not have any say in the management of the venture fund. Also, they are limitedly liable to the investment, that is, any burden of debt doesn’t fall on them. In other words, limited partners have limited power and responsibilities.

- General Partners (GPs): The venture capitalists become the general partners here. They have unlimited power and responsibilities, that is, they manage the venture fund and are fully liable for any debt taken by the LP. Although general partners make all the major decisions and guide the portfolio companies towards profitability, they are legally responsible to act in the best interest of the limited partners

The venture fund born out of this limited partnership, is managed by the management company. Here, a unique system of compensation is involved. The venture capitalists are paid in two ways:

- Management fees: The amount the venture fund managers receive to cover all the organisational and management expenses of the fund and in the form of salaries is called management fees. It is generally fixed at 2% of the value of the venture fund.

- Carried Interest: Carried interest or carry is the share of profits that the management company of the venture fund receives in case of a lucrative investment. It is generally fixed at 20%. So, even after investing only 1% of the amount of the venture fund, the general partners get 20% of the profits. The rest goes to the limited partners.

Besides this, venture capitalists are receive management fees in any case. So, even if an investment incurs loss, they have the downside protection. It’s the limited partners who actually bear the burden of losses.

However, GPs are also fully liable for any debt taken by the LP and need to protect themselves and their assets from any mishappening. So, they create a limited liability partnership (LLP).

It is through this LLP that general partners invest in the limited partnership and take loans for the VC fund while simultaneously ensuring their personal security.

You must know that an LLP borrows against its assets.

Now that the VC firm is ready to invest, it scours the market for deals, hears pitches from entrepreneurs, assesses them, conducts due diligence, and decides whom to invest in. Usually, a venture capital firm invests in many companies (called its portfolio companies) simultaneously and establishes different management bodies for each. These bodies guide the companies and provide finances, network, and expertise to facilitate their quick growth.

You must also understand that each venture fund has a definite life cycle of around ten years. So, VCs spend the first 3-4 years trying to find the right companies to invest in, and then, they work on these. Some VCs may also try building another venture fund while working on these companies. In any case, their goal is to exit in ten years by selling the stakes preferably through IPO or merger & acquisition, and pay off their limited partners.

Roles in a Venture Capital Firm

Now that we have discussed the fundamental formation and working of a VC firm, let’s talk about some of its other stakeholders. Like any other business, there are several roles and responsibilities in a venture capital firm. It has to scout the market for deals, conduct researches and analyses, value companies, run due diligence, draft memos, and execute various other activities.

The three major roles in a venture capital firm (listed in decreasing order of hierarchy) are general partners, principles, and associates. Besides them, many large firms also employ venture partners, entrepreneurs-in-residence (EIR), and analysts.

- General Partner/Partner/Managing Director: General Partners or Managing Directors are the senior-most people in the team. They raise funds, sponsor deals, and take all the major decisions of the VC firm. General partners are the ones with the highest stakes; they lose the most when a deal fails and benefit the most during a profitable exit.

- Venture Partners/Operating Partners: Venture or operating partners have part-time (and usually temporary) relationships with a VC firm. They are technically employees of the firm, who get to be on board of its portfolio companies because of their expertise, experience, and zeal. Their job is to bring new deals, manage investments in those companies, and function like GPs on the board. Venture partners are usually capable of becoming general partners. In fact, many of them are retired GPs or the ones training to become GPs.

- Principals: Principals are mid-level employees who work directly under the general partners. They are the trusted investment-focused counterparts in the team. Although Principals have no power to vote on deals, they can influence the general partners.

- Associates: Next in line are the associates. They work under the principals and usually stay for around 2-3 years. Their job is to analyse companies, bring worthy profiles to the attention of their seniors, assist in due diligence, and perform all the behind-the-scenes tasks. They are fiercely smart people who have been into the game for some time. Occasionally, a few senior associates are promoted to the post of principal.

- Analysts: A few firms occasionally roll out forms for analysts. They are usually fresh college graduates who sit in an office and crunch numbers or write memos all day. Analysts are usually inexperienced and have no power but they are smart.

- Entrepreneurs-in-residence: Entrepreneurs-in-residence or EIRs are also part-time members of a VC firm. They usually stay for around a year and act as consultants or advisors to the venture capitalist. During their tenure, they introduce the firm to good deals and assist with due diligence and networking.

Many venture firms may deviate from this conventional system; for instance, many VC firms use the titles of ‘Founding General Partner’ or ‘Executive Managing Director’ to signify seniority. Also, some give the title ‘Partner’ to their principals as well. So, although principals don’t have the power of a general partner, they are addressed in that manner. This confuses new entrepreneurs and they might waste their time speaking to the wrong person.

This is why you need to always make sure who you are engaging with. In small VC firms, you might only be talking to general partners, but it is easy to get confused in the larger ones. Always assess the actual power of the person you are speaking to. You can go through the firm’s website or talk to the entrepreneurs with whom they have worked before. While you are at it, you may also try to get an introduction to the partners directly.

However, you must remember that even the junior members of a VC firm can influence the general partners and, even if they cannot get you a deal, they can definitely ruin your chances. So, treat them with the utmost respect and try to form a healthy relationship. Principals and even associates can sometimes fix a meeting with the partner. However, insist on speaking with the senior members of the team. After all, they are the ones who will fund your business.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of this article on venture capital firm structure in the comments section.

A finance enthusiast, literature beau and lifelong learner. Working her way up the success ladder and her personal philosophy textbook, Kavvya believes that a good conversation is worth more than a good book. When not working, she can be found reading, writing and engaging in long walks.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)