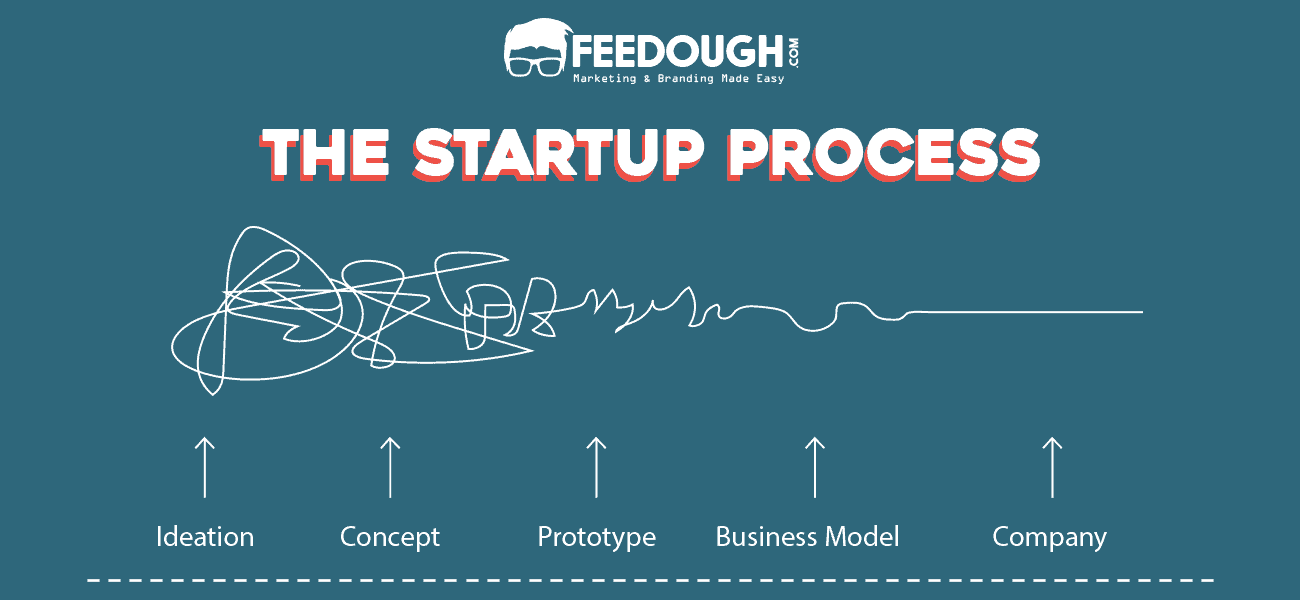

Just getting an idea for a business is hard enough – but once you’ve got that eureka moment, you’ve then got to worry about how to get it off the ground.

Now, this is where entrepreneurs make one of their first and biggest mistakes: they don’t assess whether they should bootstrap or seek out funding for their startup. The answer to this question is never black and white – it depends on a whole host of factors specific to your business, your team, and the market you’re entering.

Let’s take a closer look at bootstrapping vs funding and help you decide which is the right path for your business.

What Is A Bootstrapped Startup?

A bootstrapped startup is a company that is funded by its founder’s personal finances rather than through outside investment. This means that the founders have complete control over their business and don’t have to answer to any investors.

In simple terms,

Bootstrapping = You pay business expenses from your personal wealth.

Personal wealth can be your savings, money given to you by friends and family members, or even credit card or personal loan debt.

There are a number of advantages to bootstrapping your business:

- You retain full control over your company: When you’re the only one shelling out the cash, you get to call all the shots. You don’t have to answer to anyone but yourself, and you can decide how your business is run.

- You’re less likely to overspend: It’s easy to get caught up in the excitement of a new venture and start spending money left and right. When you’re the one footing the bill, you’re likely to be more mindful of where your money is going and less likely to make impulse purchases.

- Bootstrapping gives you freedom: When you’re not reliant on outside funding, you have much more flexibility in running your business. You can take more risks and be more experimental with your products and services without having to worry about what investors might think.

- Bootstrapping can be cheaper in the long run: If you do manage to get your business off the ground without funding, you’ll likely end up spending less in the long run. This is because you won’t have any investors to pay back, and you won’t have given up equity in your company.

There are a few potential downsides to bootstrapping your business, though:

- You may need to take on personal debt to finance your business: One of the most common ways to finance a bootstrapped business is through personal debt, such as credit cards or a personal loan. This can be risky, as you’ll be putting your personal finances on the line to finance your business. If your business fails, you’ll be left with a debt that you’ll need to repay.

- You may not be able to provide enough capital: If you’re bootstrapping your business, it may be difficult to raise enough money to finance your business. This can limit your ability to grow your business or take advantage of opportunities that come up.

- You may need to work longer hours: When you’re bootstrapping your business, you may need to work longer hours than if you had investors. This can be difficult if you have family or other commitments.

- You may need to make sacrifices: When you’re bootstrapping your business, you may need to make sacrifices in order to save money. For example, you may need to live in a cheaper apartment or give up your car.

- You may need to be patient: It can take longer to grow a business when you’re bootstrapping it. This is because you’re limited by the amount of money you have on hand.

Successful Bootstrapped Companies

Several multi-national companies that we know and love today started as bootstrapped businesses, including:

Zappos

The famous online shoe retailer was started by Tony Hsieh in 1999. Zappos was a bootstrapped company where Tony advertised his shoes in tie-ups with store owners.

The process was simple – the company used to purchase shoes as soon as an order was placed and then ship them to the customer’s doorstep.

In 2009, Zappos was acquired by Amazon for $1.2 billion in stock.

Dollar Shave Club

The Dollar Shave Club is a subscription-based business that delivers razors and other personal grooming products to your door every month. The company was started by Michael Dubin in 2011.

Michael bootstrapped the MVP by himself where he operated the Dollar Shave Club website from his apartment to validate the idea. He then raised $1 million in seed funding from Andreessen Horowitz, Felicis Ventures and other investors.

What Is A Funded Startup?

A funded startup is a business that has received money from investors – angel investors, venture capitalists, or other sources.

In simple terms, a startup is “funded” when it has received money from an outside source. The purpose of this funding is to help the startup grow and scale its business.

There are many different types of outside financing, but the most common are:

- Equity financing: This is when a startup sells shares of its company to investors in exchange for money. The investors become part-owners of the company and expect to make a return on their investment if the company is successful.

- Debt financing: This is when a startup borrows money from investors and pays it back over time, with interest.

- Convertible debt: This type of debt financing gives investors the option to convert their debt into equity at a later date.

Startup funding comes with a lot of pros, such as:

You get more capital to grow your business: This is the most obvious benefit of startup funding. You can hire more employees, buy more inventory, and invest in marketing and other growth initiatives when you have more money.

You have access to expert advice and mentorship: Many investors are experienced entrepreneurs themselves, so they can offer valuable advice and mentorship to help your business grow.

You get a built-in network of contacts: Investors typically have a wide network of contacts that they can introduce you to, which can help your business in many ways.

There are, of course, some downsides to startup funding as well, such as:

- You have to give up equity in your company: In exchange for their investment, investors will own a portion of your company.

- You have to answer to someone else: Investors will want to have a say in how your company is run, which can be difficult for entrepreneurs who are used to having complete control.

- You might not get the full amount you want: It can be difficult to raise the full amount of money you need from investors, especially if you’re not asking for a lot.

- There could be hidden terms and conditions: Startup investments come with a lot of paperwork. And this paperwork can often contain terms and conditions that the entrepreneur is not aware of.

- The process can be lengthy: It can take months or even years to raise investors’ money. And during this time, your business might not be able to grow as quickly as it could if you were using your own money.

Successful Funded Companies

Some of the most successful startups in the world have been funded by investors. Examples include:

Facebook was founded in 2004 and received its first investment of $500,000 from Peter Thiel in 2004. The company went on to raise over $2.3 billion from investors and is today valued at around $500 billion.

Google was founded in 1998 and received its first investment of $100,000 from Andy Bechtolsheim in 1998. The company went on to raise over $36.1M in funding over 4 rounds and is today valued at over $1 trillion.

Bootstrapping Or Funding – What’s Better For Your Startup?

There isn’t a “one size fits all” answer to this question. The best decision for your startup will depend on a number of factors, including the amount of money you need, the stage your business is at, and the type of business you’re running.

Choose Bootstrapping

Bootstrap your startup if:

- You don’t need a lot of money to get started: If you’re starting a business that doesn’t require much capital, such as a consulting firm or an online store, then you may not need to raise money from investors.

- Your product isn’t unique: If your product or service isn’t unique, then it may be difficult to attract investors. In this case, bootstrapping may be the best way to get your business off the ground.

- Your focus is on sustenance rather than growth: If your goal is to build a sustainable business rather than a high-growth startup, bootstrapping may be the better option. This is because you’ll have more control over your company and won’t have to give up equity to investors.

- You want to maintain control of your company: When you take money from investors, they will likely want a say in how you run your business. If you want to keep full control of your company, it’s better to bootstrap.

- You’re not ready for the scrutiny of investors: If you’re not comfortable with the idea of sharing your business plans and financials with investors, then it’s better to bootstrap your startup.

- You want to test your business idea before you commit to it: If you’re not sure whether your business will be successful, it’s better to start small and bootstrap your way to growth. This way, you can test your business idea without incurring a lot of debt or giving up equity in your company.

- You’re not comfortable with debt: If you’re risk-averse and don’t want to take on debt to fund your startup, then bootstrapping is the way to go.

- You have a low burn rate: If your startup doesn’t require a lot of money to get off the ground, then you may be able to bootstrap it. This is especially true if you can generate revenue from day one.

- You believe your revenue can fund your growth: If you’re confident that your startup’s revenue will be enough to fund its growth, then bootstrapping may be the right choice.

Choose Funding

Look for investors if:

- Your product is unique: If your product is unique and you have a competitive advantage, then investors may be more likely to fund your startup. Moreover, unique products require huge funds to develop a market around it.

- You need to scale quickly: If you need to scale quickly, then you’ll likely need investors. This is because bootstrapping takes time, and you may not be able to generate enough revenue to fund your growth.

- Your startup requires a lot of money: Certain businesses and business models require a lot of money to get started. If this is the case for your startup, then you’ll need to seek out investors.

- You don’t mind giving up some control: When you take on investors, you’re also giving up some control of your company. If you’re okay with that, then funding may be the right choice for you.

- You want someone else to share the risk: If you don’t want to shoulder all the risk yourself, you’ll need to find investors who are willing to share the risk with you.

- You believe you can repay the debt quickly: If you’re confident in your ability to repay any debt you take on, then funding may be the right choice for you.

- You want external experience on your team: If you feel like you need more experience, bringing in investors may be the right choice for you as they can provide valuable insights and connections.

Bottom-Line

There is no right or wrong answer when it comes to choosing between bootstrapping and funding for your startup. It depends on your specific situation and what you feel is best for your business.

But you should know that even investors are running their businesses and only invest in startups that have a high potential for success. So even if you choose to go the funding route, ensure you have a solid plan and business idea that will make investors want to invest in your startup.

Do your research and weigh your options carefully before making a decision. And don’t forget, there will always be ups and downs no matter which path you choose, so stay positive and focused on your goals.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on bootstrapping vs funding in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)