All it takes is an idea which forms the concept and which eventually turns into the company. Managing a startup is just like playing an RPG. An entrepreneur acts as the main character who has to proceed through many levels before reaching the top – The IPO. Startup Funding isn’t as difficult as it seems. All you need to know is to whom to contact at what level of the startup process.

Now that you know how to develop an ideal pitch deck, let’s move on to the funding phase of the startup process.

Level 1: The Company

The actual story starts after the company is formed. But there are several steps before you get to start your brand. Choosing a brand name and a logo isn’t enough. A company has to be registered to become and act as a legal entity and to perform certain functions like signing a contract, suing, etc.

Costs at level 1 of Startup Funding

Company Registration

It takes registration to convert a concept into the actual company. It’s one of the easiest yet one of the most crucial steps in the life of an entrepreneur. Company registration forms a legal structure over which everything is placed in future.

Company registration has different costs in different countries and may vary among states of the same country as well.

- USA: the cost of incorporating a company varies from $25 to a few thousand dollars, including registration fees and legal fees.

- India: the cost of incorporating a private limited company is just ₹7000 if you incorporate it with the minimum authorized capital of ₹ 1 lakh.

- UK: the cost of incorporating a private limited company varies from £12 to £100 depending upon the mode of registration. (£12 for online registration. £40 for registration by post.£100 for same-day offline registration.)

- Australia: incorporating a proprietary limited company will cost around $469.

Other Expenditures

An entrepreneur has to calculate the total amount of expenditure they will incur before contacting someone who can invest. A usual company doesn’t start to earn profits right from the start and it takes time to reach break even. The time taken to reach break-even is different in different industries.

Expenditures other than registration while starting a company usually include

- Research & Development costs: Your business hasn’t started yet. You must research about competitors, markets, etc. before getting yourself to the racetrack.

- Server costs: if your company requires an application or a website to run. These fixed costs will come under server costs.

- Operating costs: If your business requires daily/weekly/monthly transactions which will incur certain costs. These costs must be calculated and should be labelled as operating costs.

- Company assets: This expense usually includes expenses incurred for purchasing/renting office space, furniture, equipment, machinery, etc.

- Marketing costs: These costs vary from business to business. Some businesses require a huge amount of marketing costs at level one while some don’t even consider them at this level of funding.

Procurement Of Funds

It’s not the right time to contact VCs and angel investors to fund your startup as your business hasn’t started to operate yet. Usually, the funds are procured from relatives, friends, family and other contacts.

This type of investment is called seed investment. The investor actually plays a gamble by investing at your business and hence ask for a lot of shares.

A startup usually issues 100,000 shares of the equal denomination at the time of seed funding. Valuation of the firm is decided based on the investment amount and the shares given to the seed investor.

Suppose your friend invested a sum of $10,000 and asked for a 20% share in your company. The valuation of the company will come out to be $50,000 with you owning 80% of the shares worth $40,000.

Level 2: Capital Raise

You’ll need more money once your company is established. This level of startup funding requires money either for continuing the operations to reach break even or to expand the business after you’ve started earning profits (which is rare).

Procurement Of Funds At Capital Raise Level

This stage requires an entrepreneur to contact an angel investor or a venture capital firm as at this stage the business has already started operating and there are figures on which predictions and promises can be made.

An angel investor is a high net worth individual who invests in the business in return of convertible debt or ownership equity.

A venture capital firm is an organisation composed of many angel investors and other corporates who pool in their money to invest in businesses with huge growth potentials.

The money invested in the business at this level of startup funding is called venture capital. The angel investor and VC firms invest a lot of capital in the firm in return of ownership equity and a say in decision making.

Series A, B, C Funding

Once the seed has been planted, the business firm needs increased nourishment at different levels of its operation. It all starts with seed A funding followed by B, C, D, and so on. Every round of funding will dilute your ownership and will add more VCs and angel investors on board who’ll have a say in the decision making of the company.

The share percentage of every stakeholder after the capital raise level of startup funding depends on the valuation of the firm. There are two types of valuation [pre-money & post-money valuation] that must be considered while deciding the share percentage of the existing and new stakeholders of the company.

- Pre-money valuation – is the company’s value before it receives outside financing. It’s the current value of your startup.

- Post-money valuation – is the company’s valuation after it receives outside financing. If explained in simple terms, post-money valuation is pre-money valuation + the investment you’re looking to collect from VCs and angel investors.

The pre-money valuation of the company gives the current share price and the post-money valuation decides the future share prices and the number of shares the investor will receive.

Suppose, a VC agreed to invest $1 million in your company for a post-money valuation of $5 million which gives a pre-money valuation of $4 million.

Now, it’s already assumed that you’ve issued 100,000 shares previously of worth –

Pre-money valuation/ # shares outstanding → $4,000,000/100,000 → $40 per share

The investor will require issuing of new shares for his $1 million dollars. The new shares issued will amount to –

Investment/Pre-money price per share → $1,000,000/$40 → 25000 shares

Another method of calculating investors share in your startup is –

series investment/post-money valuation → investors share in your startup

$1,000,000/$5,000,000 → 20% shares

The existing stakeholders’ shares get diluted to 80%. To make it simple, you now own 64% shares of the company (which was previously 80%) and the seed investor owns 16%. This process is called share dilution.

The entrepreneurs should maintain a high post-money valuation to make sure that the investors don’t dilute their ownership much.

Level 3: Exit

Once your company is all set and has started earning profits, it’s time to sell your investments, reduce your stake in the business and earn substantial profits.

An exit strategy is a strategic plan of the stakeholders to sell their stake in the business to earn profits. You’ll have two options when it comes to planning an exit strategy.

Selling Your Company To A Corporate Giant

An exit strategy is planned right from the start. If an entrepreneur and the investors are in the business purely to earn profits and nothing else, this seems the most beneficial idea as they usually get the shares of the acquiring company (there is an option to get money too). The shares provided usually vest after a certain period of time but are a great offer for such an entrepreneur. The entrepreneur, meanwhile, works with the acquiring company where they handle the company they just sold to the corporate.

Initial Public Offering

Launching an initial public offering is a better alternative to selling your company to a corporate giant. An IPO is just another form of capital raise in the stock market where investors are the real public. Before an IPO, the company is considered private. This is why an IPO is also referred to as “going public.” There are certain rules and regulations that the company has to follow to go for an IPO. An IPO results in every share becoming a tradeable document whose price is decided based on the market factors like demand and supply. You will continue to have the number of shares you had before, but the decision-making of the company now shifts to the board of directors elected by a majority of the shareholders.

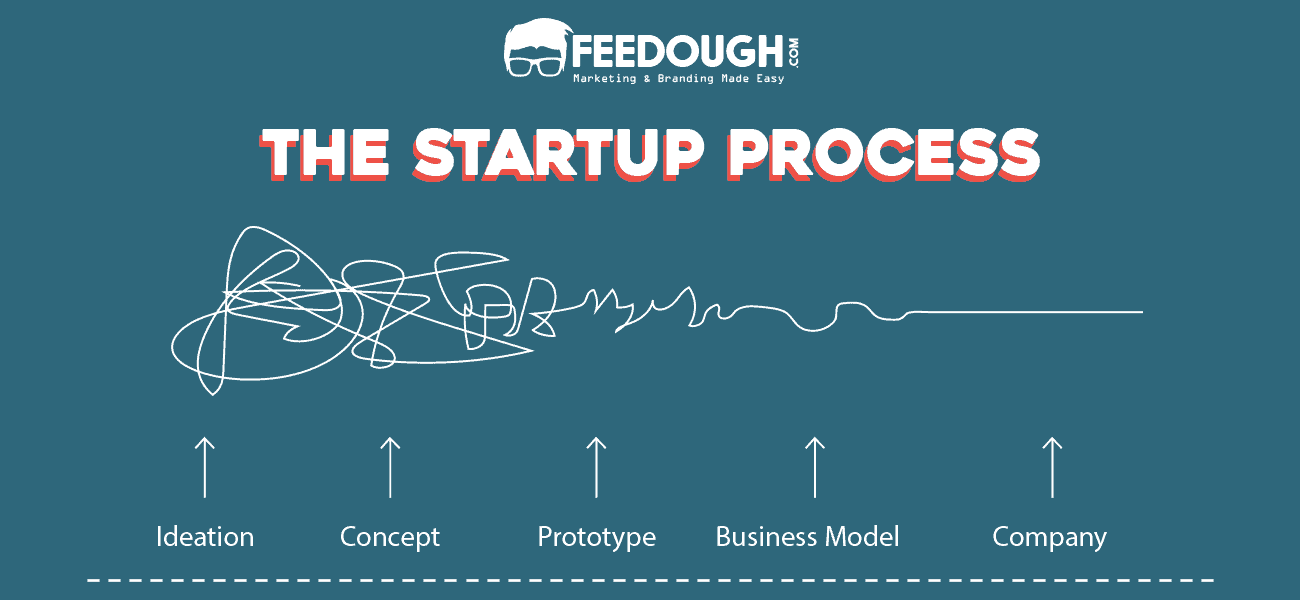

The Startup Process

We know how important your dream business is to you. Therefore, we’ve come up with an all-in-one guide: The Startup Process to help you turn your vision into reality.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)