The 10 Best Financial Management Tools

Managing finances properly is important for any business, big or small. You need to keep track of where your cash is coming from, where it’s going and see how well you’re doing financially. Plus, you’ve got to plan for the future as well.

But you can’t do all this with just a calculator and a notepad. That’s where financial tools come in handy. They can help you create detailed reports, manage your cash flow, and even handle payroll. Here’s a tightly curated list of the 10 best financial tools designed to help businesses like yours succeed.

Rundown

- Best for creating a financial plan: ProjectionLab, “A user-friendly platform to create detailed financial plans with customisable projections.”

- Accounting tool to manage all your finances: Wave, “Free accounting software for small businesses and freelancers. Includes features for invoicing, receipt scanning, and financial reporting.”

- Best for budgeting: YNAB (You Need a Budget), “Assign every dollar to a specific purpose and adjust budgets to stay on track with financial goals.”

- To track your expenses: Expensify, “Simplifies expense tracking with receipt scanning and automatic categorisation. Ideal for both personal and business use.

- For investment management: Sharesight, “Manages and tracks all your investments in one place making it easier to manage your investment portfolio. ”

- For payroll management: Gusto, “Processes employee salaries, manages tax deductions, and ensures compliance with labor laws.”

- For risk management: RiskWatch, “Identifies, assesses, and reduces financial risks effectively.”

- For invoicing and billing: Freshbooks, “Manages invoices, expenses, and time tracking for freelancers and small businesses.”

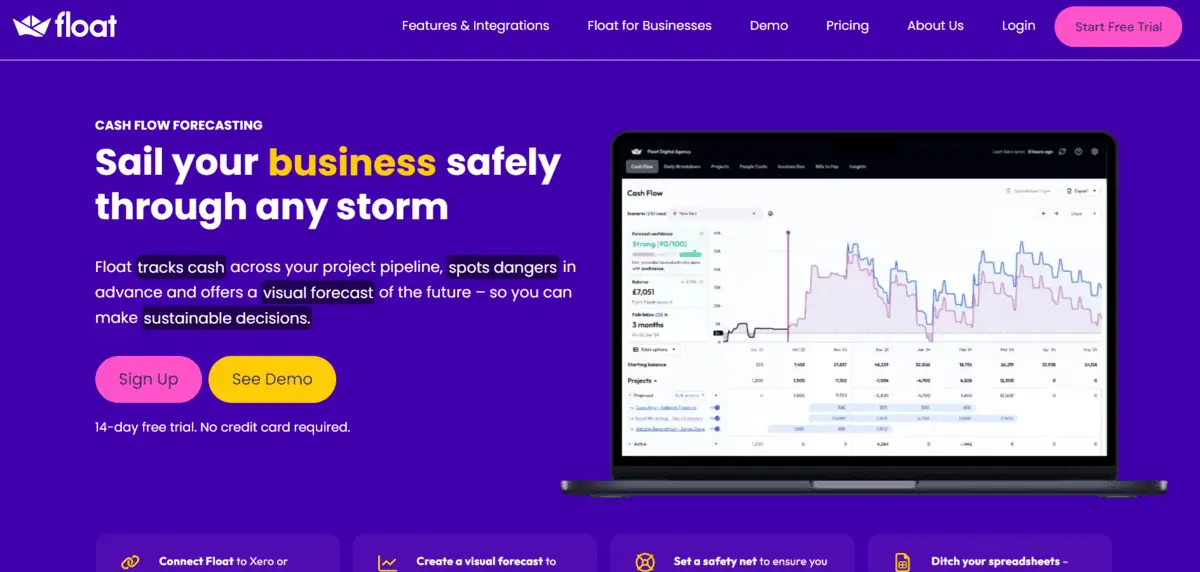

- For cash flow management: Float, “Monitors cash inflows and outflows.”

- For tax planning: TurboTax, “Calculates taxes, prepares tax returns, and ensures compliance with tax regulations.”

Recommended Financial Management Tools

Best for creating a financial plan

If you want to make a proper financial plan for your future, ProjectionLab can help. This financial management tool makes understanding and planning your finances easier. You can enter your information, like earnings, spending, savings, and debts. It then shows you how your money could grow or change over time. You can make different plans and compare them, or try out “what if” situations like retiring early or making a big purchase. It shows you many possible outcomes to help you make better choices and plan out your finances.

With ProjectionLab,

- You can set and keep track of money goals like saving for a car, retirement, or education. ProjectionLab helps you understand what steps you need to take to reach these goals.

- You can see your financial information in charts and graphs. This makes it easier to understand your situation and plan for the future.

- You can also test different scenarios to see how changes in your income, expenses, or investments might affect your future finances. This helps you make better-informed decisions.

- ProjectionLab can be easily connected to your bank accounts and other financial accounts. This lets you view all of your finances in one place.

While ProjectionLab has many useful features to offer, it might be more expensive compared to other tools especially if you’re on a tight budget. Also, if you want to create a more sophisticated and complex financial plan, you might find the customisation options limited.

Best for budgeting

You Need a Budget (YNAB) is a money management app for those who want to take control of their finances by creating proper budget plans. With this financial management tool, you can see exactly where your money is going and make sure you’re sticking to your budget. It works by making you give every dollar you earn a specific job. For example, if you have $1000, YNAB helps you split this money into different groups like paying bills, rent, and other expenses. Any money left over can then be assigned to your future plans, like saving for a laptop or a new phone.

In this way, the app makes it simple to create a budget and helps you stay on track with your financial goals. Other than that,

- You can connect YNAB to your bank accounts so that you get up-to-date information on your spending and budget.

- You can also set and track specific financial goals, whether it’s saving for a vacation or paying off debt.

- YNAB gives you detailed reports on your spending and budgeting trends, helping you see where your money is going and how you can improve.

YNAB is a helpful app for budgeting, but it does have a few downsides. While you can try it for free at first, you’ll need to pay to keep using it after the trial ends. Also, sometimes you have to manually type in your purchases yourself, which can be a bit inconvenient.

To track your expenses

Expensify could be your go-to tool if you want to manage and track your expenses easily. This financial management tool lets you take pictures of your receipts and automatically sorts your expenses into categories like food, travel, office supplies, etc. You don’t have to type in everything yourself or remember where you spent your money. The app does most of the work for you. This makes it much easier to see where your money is going and create expense reports.

- Expensify uses smart technology to categorise your expenses based on the details from your receipts. This helps you keep everything organised and in one place.

- For those who drive for work, Expensify can track your mileage and include it in your expense reports.

- If you travel internationally, it can handle expenses in different currencies, converting them to your home currency for easy tracking.

- You can also integrate Expensify with accounting tools like QuickBooks, Xero, and NetSuite, making it easy to sync your expenses with your accounting system.

While Expensify is a great tool for managing expenses, there are some limitations to consider. Some of the more advanced features require a paid subscription, and it can take time for you to get used to all the features and settings. Sometimes the automatic categorisation might not be accurate so you’ll have to make manual adjustments.

ccounting tool to manage all your finances

Wave could be the perfect financial management tool for small business owners, freelancers or just anyone looking for an easy and free way to manage their finances. It’s an accounting software with which you can easily keep track of the money coming in and going out of your business. You can also use it to send invoices to your customers, take pictures of your receipts to save them and create reports that show how your business is doing financially.

- You can customise your invoices with your logo and brand colours.

- You can use the Wave mobile app to scan and digitise your receipts. This helps you keep track of your expenses and makes sure you don’t lose any important documents.

- Wave automatically imports and categorises your expenses from your bank accounts and credit cards. This makes it easy to see where your money is going and track your spending.

- Wave also helps you match your bank statements with your accounting records, ensuring everything is accurate and up-to-date.

Wave is a great tool for managing your business finances, but it’s not without any limitations. While it does many things well, it can’t be integrated with other business tools. Also, you’ll need to get a paid subscription if you want to use it to pay employees.

For investment management

Sharesight is for investors who want to manage and track their investments without much hassle. This financial management tool helps you keep all your investments in one place so that you can monitor your portfolio’s performance and make informed decisions. You can track all kinds of investments, like stocks, mutual funds, ETFs, and more. It automatically updates your portfolio with the latest prices and gives you detailed performance metrics.

With Sharesight,

- You can get detailed reports that show how well your investments are doing, including money from dividends, changes in currency values, and fees.

- You can track the money you get from dividends and even choose to reinvest it.

- You can also make tax time easier with reports that show your gains, losses, and dividend income.

- You can compare how your investments are doing compared to the overall market.

- Sharesight can also be connected with other money tools and brokers to easily update and manage your investments.

Sharesight is a great investment management tool, but like any other tool, it also has some drawbacks. To access more advanced features, you’ll have to pay. It might take you a little while to learn how to use all its features. Also, if your broker isn’t on the list, it might be harder to import your investment information.

For payroll management

If you’re a small to medium-sized business and need a reliable, all-in-one solution for managing payroll, benefits, and HR, Gusto is for you. It makes paying employees much simpler by automatically calculating wages, deducting the right amount of taxes, and making sure you follow labour laws. With Gusto, you can easily set up direct deposits for your workers, manage employee benefits like health insurance and retirement plans, and also keep track of paid time off.

- Gusto calculates and processes payroll automatically, making sure your employees are paid correctly and on time.

- It can handle all your federal, state, and local tax filings, so you don’t have to worry about missing deadlines or making mistakes.

- You can easily manage health insurance, 401(k) plans, and other benefits directly through this tool. It also simplifies enrolling employees and managing contributions.

- You can access tools and resources to manage employee records, track paid time off, and make sure all legal requirements are met.

Gusto is a good payroll tool, but it has some downsides. It can cost more than simpler payroll options, which might cause a problem for small companies with a limited budget. While it handles common payroll tasks, companies with more complicated needs might not find all the options they want.

For risk management

For those who want a reliable way to manage financial risks, RiskWatch is for you. It helps you identify potential financial risks, provides tools to assess how serious they might be, and offers strategies to minimise them. This way you can protect yourself from any potential threat.

- RiskWatch uses advanced data analytics to find weak spots before they become problems.

- It helps you figure out which risks are big and likely to happen, so you know which ones to deal with first.

- The software gives you ways to make plans to lower or get rid of risks. You can create to-do lists and give tasks to your team.

- It keeps track of rules your business needs to follow and alerts you if you might be breaking any.

- RiskWatch also makes reports that show how well you’re handling risks. You can change these reports to show what your business needs to see.

While it’s a great tool for risk management, RiskWatch can be on the pricier side, especially if you have a low budget. Learning how to use this tool can also take some time.

For invoicing and billing

FreshBooks is for freelancers, small to medium-sized businesses, and self-employed professionals who want an easy way to manage their finances. With this financial management tool, you can create and send professional invoices, track your expenses by taking photos of receipts or connecting your bank account, and log your working hours with a built-in timer. The software helps you get paid faster with online payment options, categorises your tax expenses, and lets you turn tracked time into accurate invoices. It’s user-friendly, so you don’t need to be an accounting expert to keep your business finances in order.

- You can create professional-looking invoices quickly. You can also customise them with your logo and personalise the layout. The system sends automatic payment reminders, so you don’t have to ask clients for payments.

- You can easily keep track of all your business expenses by taking photos of receipts and logging them in FreshBooks. This helps you record your spending and makes tax time less stressful.

- If you bill by the hour, FreshBooks can help you log your hours and attach them to specific projects or clients, so you can bill them accurately.

- You can also generate detailed reports on your income, expenses, and profits. These reports can help you understand your business’s financial health and make informed decisions.

While Freshbooks is a great tool for invoicing and billing it can be quite expensive compared to some other invoicing tools, especially if you want advanced features or have a lot of clients. Customisation options are also limited.

For cash flow management

If you’re a small to medium-sized business owner or a financial manager looking for a way to keep track of your cash flow, Float could be your tool. This financial management tool helps you monitor and manage your cash inflows and outflows, so you can check your financial health. With Float, you can visually map out your money’s position to spot any potential shortfalls or surpluses in advance. It also lets you create “what-if” scenarios, so you can understand how different business decisions might affect your cash flow. It can be integrated with your accounting software, and it automatically updates your cash flow so you don’t have to enter any data manually.

With this finance management tool,

- You can predict future cash flow based on your past financial data.

- Float gives you real-time updates on your cash flow. This makes sure you always have the most up-to-date information.

- You can create different financial scenarios to see how changes like increased expenses or low revenue will affect your cash flow.

- You can also set budgets for different categories and track your spending against these budgets. This helps you stay on track and avoid overspending.

Float is a great tool for cash flow management, but it has a few limitations to consider. It can be costly, especially if you’re on a tight budget. Float mostly relies on your accounting software, so if there’s any issue with your accounting system, it will affect Float as well.

For tax planning

Turbotax is for anyone looking for a trustworthy way to manage their taxes. This financial management tool can calculate your taxes, prepare tax returns, and help you stay in compliance with tax regulations. It helps you with the whole tax filing process and manage your taxes efficiently. You can either get the help of experts available on the platform or just do everything yourself. Either way, TurboTax guides you through the whole process.

It’s a helpful finance management tool that provides many features and utilities like

- TurboTax can automatically calculate your taxes based on the information you provide. It makes sure that all calculations are accurate and compliant with current tax laws.

- It asks you questions about your income, expenses, and deductions, and fills out the necessary tax forms for you.

- Before you file, TurboTax checks your return for errors and omissions. This reduces the risk of mistakes that could delay your refund.

- If you need any help, TurboTax also offers various support options, like access to tax experts and live chat assistance.

Like any other tool, TurboTax also has some limitations. It may not handle complex tax situations well, especially for businesses with many transactions. Also, you’ll have to enter all of your information manually, which can take time.