Have you ever put something in your shopping cart only to regret it later? Well, you’re not alone. We’ve all been there.

It starts with a hasty or heavily influenced purchase decision. However, as soon as the money exchanges hands and you own the item you’ve been dreaming of, you start to experience an uneasy knot in your stomach. You begin to doubt your decision and whether or not the purchase was justified.

“Do I really need it?”

“Is it really better than the one I didn’t buy?”

This feeling that you experience is buyer’s remorse.

Don’t worry, it’s entirely natural, and it’ll pass once you’ve adjusted to your new purchase and the shock of spending money has worn off.

But the question is: Why do you respond in this manner after making a significant purchase? Is there a way to avoid buyer’s remorse the next time you buy something big? Or is there a way for you as a seller to prevent buyer’s remorse for your customers?

Let’s find out.

What Is Buyer’s Remorse?

Buyer’s remorse is a feeling of regret or anxiety after having made a purchase. It might happen with something as trivial as a cup of coffee or something as important as real estate or a car, and often the guilt is accompanied by stress and panic.

It is a term used to describe a period of mental discomfort or a strong negative reaction to a purchase that can be linked to a variety of factors resulting from conflicting beliefs and attitudes. It can be the fear of overspending, discovering a better deal, worrying that you haven’t made the best decision, or simply being depressed because the purchase you made isn’t exactly what you wanted.

Types Of Buyers Remorse

According to recent research in the United Kingdom, 82% of customers expressed regret or guilt over a previous purchase.

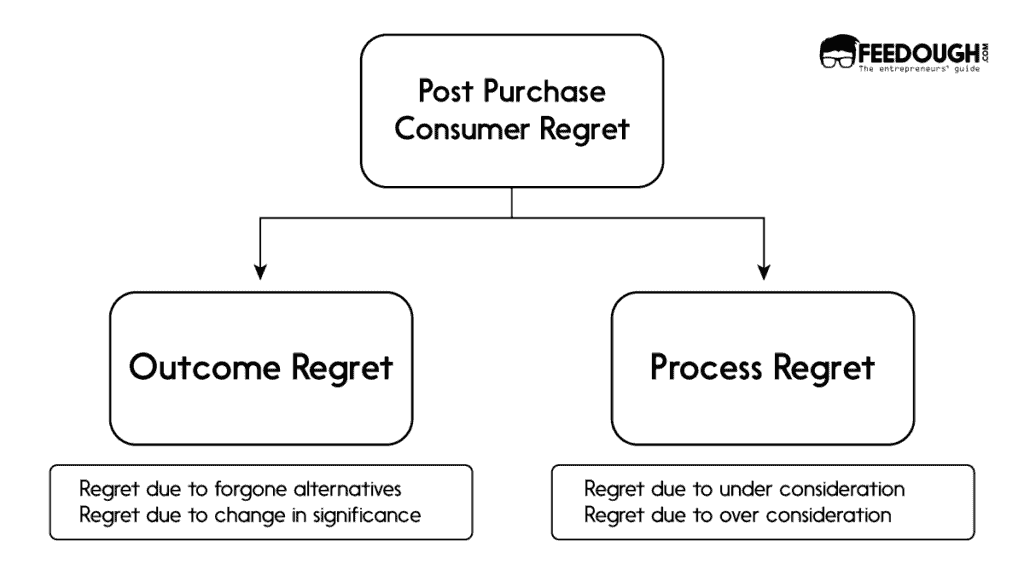

Usually, this feeling arises from two categories of post-purchase regret. They are:

Outcome Regret

It’s the regret you experience from your purchase outcome. It is triggered when you get the feeling of “This product isn’t what I needed.”

- Regret due to forgone alternatives: When you chose one alternative over others, and the forgone alternative has a perceived better outcome than the current outcome.

- Regret due to a change in significance: When the actual utility get from the purchased product is less than the perceived utility. In simple terms, the purchased product is unable to meet your expectations.

Process Regret

It occurs when you give yourself the blame for having a faulty purchase process.

- Regret due to under consideration: When you wish, you should have put more effort into making the purchase decision.

- Regret due to over consideration: When you wish you could have made less effort to obtain the desired result.

Psychology Behind Buyer’s Remorse

Most of the time, buyer’s remorse is stated as a natural human reaction arising from a feeling of caution. However, psychologists believe that the phenomenon of buyer’s remorse is associated with the psychological notion of cognitive dissonance and the approach and avoidance mechanisms.

Cognitive Dissonance

Cognitive dissonance is a feeling of psychological distress that happens when you’re at odds with your thoughts.

After every purchase, you go through a period of post-purchase rationalisation, convincing yourself that you made the right decision by weighing the positives over the negatives. However, when this process leads to doubt, there is buyer’s remorse.

Buyer’s remorse or psychological pain is a form of cognitive dissonance that is more likely to occur when you invest a substantial amount of resources, such as money, time, and cognitive resources, in purchasing an item.

There are three key aspects linked to cognitive dissonance and buyer’s remorse:

- Effort refers to the resources invested in a purchase, like time and money, proportional to the transaction’s importance. Buyer’s remorse is more likely to occur when purchases necessitate a lot of effort but don’t yield many benefits.

- Responsibility alludes to the fact that the purchase was made voluntarily. If you had a choice and made the purchase at your own free will, you are more likely to feel dissonance as you don’t have anyone else to blame for those erroneous purchases.

- Commitment refers to the continuation of an action. Simply put, it means that now that you have made the purchase, you’ll have to live with that new-found, potentially not-as-cool-as-you-thought object for quite some time.

The Approach And Avoidance Mechanisms

Another theory behind the psychology of buyer’s remorse is given by Art Markham, a psychology and marketing professor at the University of Texas. According to his research, buyer’s remorse is grounded in two distinct processing systems: the avoidance motivational system and the approach motivational system.

The avoidance mechanism instructs you to avoid the purchase by providing justifications. On the other hand, the approach system encourages you to pick your happiness; it is more concerned with immediate gratification than long-term effects.

For instance, when you go shopping, the approach system has the upper hand. Markham explains,

“When you see a new pair of shoes, a terrific dress, or a fantastic top, you think about how much you want to own it. Then, you’re purely governed by the approach system while your avoidance system plays a negligible role. However, once you’ve made the purchase, the approach system is switched off, and avoidance concerns take their place, and you start to consider all of the implications of your purchase.”

This is how buyer’s remorse manifests itself.

What Causes Buyers’ Remorse?

Buyer remorse is never the cause of regret. It is the regret resulting from several triggers that include:

Expensive Purchases

Expensive offerings often result in both outcome regret and process regret as they involve all three cognitive dissonance elements – effort, responsibility, and commitment.

The more expensive an offering is, the more unlikely it is that you buy it without thought or effort. Expensive offerings make you compare it with alternatives, resulting in a process regret.

Moreover, such offerings may also result in outcome regret as you might have raised your expectations depending upon the money you pay for it.

Impulse Purchases

Impulse purchases result from a strong, sometimes irresistible urge to buy the offering. Social media, fear of missing out, and other factors disrupt the usual buying process of customers, making them make decisions powered by emotions rather than rational thinking.

Today, there’s an increasing trend of people making purchases because they saw a product online, irrespective of whether they need it or not. Moreover, many customers belonging to the younger generations buy something “simply for the gramme” (read: simply to show off on social media).

It might sound ludicrous to purchase to please a social audience, but social media and FOMO form a strong trigger for spontaneous purchases, resulting in increased buyer’s remorse.

In fact, Gen Z has the highest percentage of buyer’s remorse, with 70.8% of them agreeing to the fact that they bought an item simply to look cool in the eyes of their social media audience.

External Stimuli

External stimuli are marketing cues used by marketers to attract and lure customers to buy their offerings. It constitutes advertisements, personalised marketing, targeted marketing, in-store promotion, sales promotion, etc.

Today, marketers know more about your interests than you do. They use this data to stimulate your demand for their offerings.

Strategies like marketing scarcity, discounts, targeted advertisements, remarketing, etc. make sure you fulfil your desires by making a purchase.

For example, you become a prime target for remarketing tactics when you leave a website without completing a purchase. The brand makes it their mission to make you complete your purchase and excute this plan using methods such as social media ads, discount pop-ups, and other intrusive methods.

“Have you forgotten anything?” Emails and advertisements like this assist brands in devising strategies to entice you to buy things that you may later regret.

Interpersonal Influence

Interpersonal influence is the degree to which others influence your decision. It includes two dimensions –

- Informational influence: It is how you perceive information gathered from knowledgeable others as your evidence of reality. For example, when you rely on your techy friend’s advice on buying a good laptop.

- Normative influence: It is how your purchase decisions are influenced just to maintain your image in the eyes of significant others. For example, when you buy a 55 inch TV instead of 43 inch TV just to look good in the eyes of your office friends.

The more susceptible you are to interpersonal influence, the more chances are that you will suffer from post-purchase regret.

Paradox Of Choices

Several solution options to one problem often result in cognitive dissonance as the option you choose may lack some of the features the other option had to provide. Moreover, it also leads to the regret of over consideration, where you feel guilty of spending too much time to something that could have been done sooner.

But, you are unlikely to be disappointed with your purchase if you know your triggers and take some simple, meticulous precautions before purchasing. So, what are these precautions? Let’s find out.

How Can Customers Avoid Buyer’s Remorse?

When you realise you’ve overspent your budget or the psychological “high” of the purchase wears off, it leaves you with buyer’s remorse. But, buyer’s remorse is hard-wired into our minds, so it’s unlikely to escape it completely.

So, when temptation rears its ugly head, remember these guidelines that will help you to improve your financial decisions and reduce the amount of regret you experience.

Practice Setting Shopping Boundaries

Your purchases would become much more deliberate once you remind yourself to budget. Start debating your inner voice whether you actually want or need the item.

Learn to see urgency as a red flag and make purchase decisions by separating your emotions and examining your needs and finances.

If it isn’t something you’d use and enjoy practically every day, it’s probably not a good use of your hard-earned money.

Equate Price To Work Hours

Take a few minutes before purchasing to calculate how many work hours it will take you to recoup the cost of the item.

For example, if you earn $100 a day and decide to buy $500 worth of home decor at the spur of the moment, it will take you around five days of work to cover the expenses.

So, do this simple calculation, every time you’re tempted to buy something that isn’t on your shopping list.

The knowledge that the “extra” item that you’re currently swooning over can cost you days of work may persuade you to reconsider your purchase.

Research Before You Buy

Have you done any research on the item before purchasing it? If you answered no, you should seriously begin incorporating research into your purchasing strategy.

The more information you have before purchasing a product, the less likely you will regret your decision afterward. This is because knowing what you’re buying and reading reviews can assist you in fathoming what you’re getting yourself into. But also learn to stop your research when you get your answer of “Whether this product will solve my problem or not?”.

Wait For 72 Hours

Before purchasing anything expensive you’ve had your eye on, take a step back and wait, rather than hopping online or running to the store immediately.

This one does need a lot of willpower, but it is effective. Creating a buffer between a stimulus (the item you want to buy) and the final response (purchasing or not buying that thing) can help you determine whether you bought something on impulse or if it’s something that will add true worth to your life.

Experts recommend deliberating about a purchase for at least 72 hours before making a choice. If you still desire the item after this period, you’re less likely to be disappointed with your purchase.

Avoid Shopping Apps

The average U.S. smartphone user spends three hours and fifteen minutes daily on their phones. A significant portion of that time is spent on various apps, including a shopping app.

Scrolling through Instagram and seeing an enticing sponsored post or “window” shopping on a secondhand or retailer’s app becomes addicting and can breed buyer’s remorse.

In fact, 64% percent of the respondents in a survey admitted they would save money if they stopped buying things online.

So, delete any non-essential app and unsubscribe their email alerts that encourage you to spend so that you don’t have to deal with the consequences later.

Use Cash Instead Of A Credit Card

This can help you stick to your budget and avoid racking up credit card debt. Don’t be fooled into thinking that spending all of the money in your wallet won’t result in some buyer’s remorse.

Stick To Your Shopping List And Follow A Budget

Before you go shopping, make a comprehensive list of what you want to buy so that you don’t end up buying things you don’t need and regret afterward. Thus, this list can help you stay on track.

For instance, before you start out looking for a house or a car, establish a list of the features you absolutely want. Set a budget and stick to it. Don’t get sucked into paying thousands more for features you didn’t even realise you needed.

Also, remember to stick to your budget. Even if you shop with credit cards, you have to keep your spending under control.

Lastly, if you frequently have buyer’s remorse, enlist the support of a close family member or friend to help you stay accountable for your purchases.

How Can Sellers Prevent Customers from Buyer’s Remorse?

Without a doubt, as a customer, one must be mindful of buyer’s remorse.

Even yet, the sellers equally must make their customers feel at ease with their purchase and not make them feel as if they have made a mistake in placing their trust in them.

A seller devotes a significant amount of effort and resources to build strong customer relationships only to discover that their customer has buyer’s remorse and has started to detest their relationship with you.

So, buyer’s remorse is also a nightmare scenario for a seller.

Thus, preventing buyer’s remorse among the customers is not only an ethical move, but it can also pay off in terms of a better brand reputation and long-term sales.

Here are some steps that can help a seller prevent buyer’s remorse in their business.

Provide Value To The Customers

Customers expect sellers to value them and provide a good customer experience. Thus, as a seller, one needs to analyze their customer’s journey data and find out as much about their customers. This will help them in understanding the foundations of their relationships with the customers. It will also help them see things through the eyes of the customer, thus, allowing them to focus on actions that will benefit them. As a result of this, the customers will be less prone to have post-purchase regrets.

Recognise The Causes

To assist customers in avoiding buyer’s remorse, a seller must first understand what causes it.

Though every person is different, post-purchase regret is commonly caused by two factors:

- Outcome regret, or

- Process regret.

The key to avoiding buyer’s remorse is to provide precise and thorough information to the customers. Sellers must demonstrate that there is nothing to conceal by offering transparent information and removing the fine print from their goods. If a seller can do this, they’ll drastically lower their chances of misleading potential buyers.

Educate The Customers

A company can portray itself as trustworthy and gain public trust by successfully educating its customers about its product. Another advantage of investing consistently in educational content is that sellers can eventually establish themselves as thought leaders in their field.

Excellent resources for educating potential customers are through a company’s blog. Aside from blogging, social media can be used to disseminate educational content.

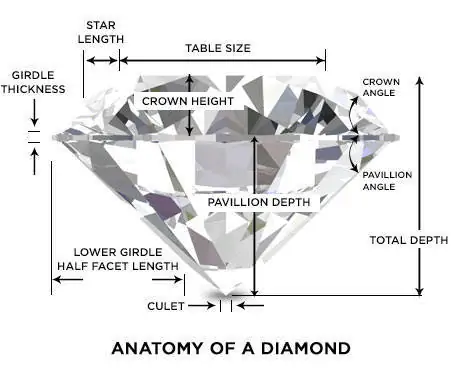

For instance, Diamondere, a leader in online jewellery sales, provides good educational content even if it means losing a transaction now and then. This company does an excellent job of being upfront and honest with customers throughout the process.

Providing Timely Responses And Contact Information

Sellers must provide direct phone numbers, email addresses, and links guaranteeing that if a customer has any concerns, someone will respond within a certain amount of time and that someone will work closely to help them.

This way, the customers will never feel on their own, and after they’ve figured out how to utilise the product, they’ll be less likely to abandon it. Also, customers want to find the most relevant information in the shortest period of time. Thus, a company can generate more leads and sales opportunities if it responds promptly to its customers’ inquiries.

Applying A Lenient Return Policy

Peace of mind is important to online shoppers. They want to be able to return the goods and get their money back as soon as possible if the product does not fit them. Thus, for a seller extending their return date is one modest tweak that might improve sales and decrease buyer’s remorse.

A flexible return policy earns the consumer’s trust because customers have ample time to test the item and determine if it fits them or not.

Zappos, for example, is a well-known online shoe shop with a flexible return policy. The company gives a full refund for items bought within 365 days of purchase.

Buyer’s remorse can strike even the most devoted customers. There will always be that one buyer who will regret their decision and return goods. However, businesses can reduce their losses using the correct approach and strategies.

As far as consumers are concerned, don’t be too harsh on yourself. Just because you’re regretful now doesn’t imply you didn’t genuinely want the goods or that you made a poor decision. Simply be cautious the next time you’re considering purchasing anything, and consider taking a break to evaluate if you truly need that item after all…

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of this article on buyer’s remorse in the comments section.

An avid reader and economics enthusiast who is always eager to learn. Prachi is an aspiring leader who believes in what she does. Besides reading , she is fond of baking , dancing and travelling.

![What Is Demand Generation? [The Ultimate Guide] What Is Demand Generation?](https://www.feedough.com/wp-content/uploads/2019/05/DEMAND-GENERATION.webp)

![Go-To-Market Strategy [The Ultimate Guide] go-to-market strategy](https://www.feedough.com/wp-content/uploads/2019/10/go-to-market-strategy.webp)