Managing a company is an incredibly complex process that involves many moving parts and decisions. No single person or entity can manage everything at once.

Hence every incorporated company has a body or panel of specially elected members to oversee its management and operations. This panel or body is the board of directors.

Here’s a detailed guide elaborating what a board of directors is, its functions and responsibilities, importance, types, appointment and disqualification.

What Is Board Of Directors?

The board of directors is the governing panel of elected shareholders of a company responsible for setting the strategy and overseeing management.

Commonly referred to as the board, it acts as the decision making authority of any corporation and establishes policies for the effective management of the company. However, the primary duty of the board of directors is to safeguard the interests of the shareholders and protect their assets to ensure that they get a good return on their investments in the organisation.

The board is also responsible for the company’s overall functioning and represents all the activities of the company. This means the board considers all the internal and external factors that may affect the company’s overall performance and considers any issues raised by shareholders and members to ensure the smooth functioning of the company.

Generally, the country laws of several nations require only the public companies to have a board but numerous private companies and not for profit companies also appoint a board for better management and functioning.

Shareholders are people who own the shares of the company stock. They have a vested interest in the company as they benefit from its growth and lose with every wrong decision. These shareholders have a say in how the company is run as they are entitled to vote on matters that affect the company. Hence they are a vital part of the company’s functioning.

Importance Of Board Of Directors

No modern corporation can function effectively without a board of directors. Directors are important because they represent the company’s shareholders and protect their interests and assets.

As most organisations have many shareholders, it is impossible for them to make any decisions or policies. Hence, they elect directors to make company policies and strategies on their behalf for the company’s proper functioning and to ensure consistent growth and profits.

The board of directors has more powers and functions than the CEO and is usually responsible for the appointment of the CEO and other executive officers.

Functions Of The Board of Directors

Primarily, the board of directors have two core functions – oversee the company’s management and protect shareholders’ interests. These core functions are subdivided into several specific functions like –

- Determining the vision and mission of the company and establishing its purpose.

- Deciding the appointment, roles and compensation of senior executives like CEO, CTO, COO, etc.

- Creating and establishing dividend policies, payouts and stock option policies.

- Leading acquisitions and mergers with other companies and organisations.

- Responding to and managing any crises that arise within the company.

- Setting company goals and providing necessary resources for their fulfilment.

- Managing and maintaining the funds and financial resources of the companies.

- Establishing company policies and strategic plans for efficient management.

- Determining, monitoring and strengthening the organisation’s products, services and programs.

- Being accountable for the organisation’s performance and actions and enhancing its public image.

- Ensuring legal compliance and ethical integrity of the company.

Responsibilities Of The Board of Directors

The board of directors is responsible for the company’s operations to not only shareholders but also to the employees, customers, suppliers, creditors, government, and other stakeholders.

General Responsibilities

- Establishing the mission, vision and objectives of the company. The directors decide the organisation’s short term and long-term goals and lay strategies on how to achieve them.

- Deciding the organisational structure of the company. The board of directors designs the structure of management based on the size and scale of the organisation.

- Selecting top-level executives and managers. The board decides the selection of chief executives and upper management.

- Formulating and implementing policies and strategies to ensure efficient management and the smooth functioning of the organisation.

- Managing and allocating the finances and resources of the corporation for growth and profits.

- Protecting the assets and interests of the shareholders and ensuring they receive the Return on Investment (ROI).

- Monitoring and evaluating the performance of the company and its employees.

- Monitoring and improving the organisation’s products and services.

- Deciding the dividend policies, payouts and stock option policies.

- Taking accountability for the actions and performances of the organisation and ensuring legal compliance and integrity.

Legal Responsibilities

- Duty of care: The board members are expected to have a level of competence and must exercise reasonable care and caution when making a decision for the organisation.

- Duty of Loyalty: The board members should have a degree of allegiance to the organisation and are expected to act in the organisation’s best interests. They should not use the information and resources of the organisation for personal gain.

- Duty of obedience: The board members must show consistency in achieving the goals and objectives of the organisation and advocate on behalf of the organisation. They should also abide by the laws as well as the internal rules and regulations of the organisation.

Types Of Board Members

An effective board has several members to represent the shareholders and carry out the necessary tasks of management of the organisation. Some of the members are:

Based on the type of directors:

- Outside/External directors: These directors are independent members (not the organisation’s employees) who are not involved in the corporation’s day-to-day operations but are reimbursed for their services. They are often experts in business or corporate fields who provide their views and experience for decision and policymaking.

- Inside/Internal directors: These members are the organisation’s employees who have extensive experience and knowledge about the functioning of the company. They are not compensated or reimbursed as they are already C-level officers, major shareholders, or a representative of the organisation.

Based on the director’s post:

- Chairman: Also referred to as the president of the organisation. They are the acting head of the board of directors who provide directions for the board. In many cases, the CEO acts as the chairman.

- Vice-Chairman: Also called the vice-president. They serve as the head of the board in case of the chairman’s absence.

- Treasurer: Member responsible for managing the organisation’s financial resources. They do not take part in the day to day operations of the organisation. They are responsible for annual budgeting, creating financial policies, investments and financial audits.

- Secretary: The secretary is responsible for creating and maintaining corporate records and other critical corporate documents.

- Executive director: Directors who hold executive positions within the company. In the USA, it’s the CEO or managing director of the company. In the UK, it can be an elected member on the board who is also an employee with a senior role in the organisation.

- Shadow or de facto director: Directors who control or direct the board are not listed as board members. The shadow director is someone who makes directorial decisions behind the scenes. De facto director is someone who fills the role of the director without being formally appointed.

- Nominee director: A director nominated or elected by interest groups, creditors or shareholders to protect their interests.

- Celebrity director: Directors who are well-known or people of repute that bring credibility, goodwill, and influence to improve public image.

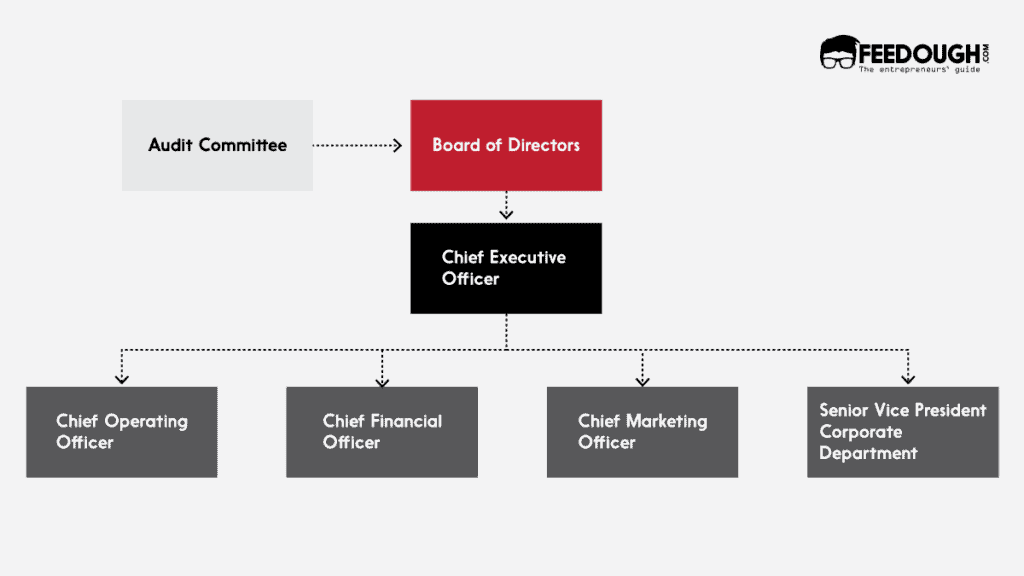

Structure Of The Board of Directors

The basic structure of the board of directors differs from company to company. The structure of the directors and their responsibilities are determined by the bylaws of the organisation and country laws.

The organisation’s Articles of Association specify the organisation’s bylaws, the total number of board members that can be there, the process of election of board members and the frequency of board meetings. There are commonly 3-31 board members.

The chairman heads the board.

It also consists of internal directors elected by employees and shareholders. These internal directors oversee the company’s daily operations and manage the interests of shareholders, officers, and employees and external directors who represent those who function outside of the company.

Appointment Of Board Of Directors

The process for the appointment of the board of directors is generally specified in the Articles of Association of the organisation. It differs for every company and depends on the needs of the organisation, the industry in which the organisation operates and the interest of the shareholders.

The board members are generally elected by the shareholders of the company at the annual shareholder’s meeting.

A director can be elected for at least 5-10 years but this differs amongst different companies. The tenure can also sometimes be extended.

Disqualification Of Board Of Directors

The board of directors can also be disqualified or suspended from the panel either for a limited time or permanently for the following reasons:

- Involvement in case of fraud, misconduct or any other criminal charges.

- Utilising company assets and funds for personal gains.

- Inability to maintain proper corporate and accounting records.

- Failure to pay taxes and debts owed by the company.

- Abusing directorial powers and working against the interests of the shareholders and the company.

- Any conflict of interest arising between the director and the organisation.

- Colluding or making deals with outside individuals against the organisation.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on board of directors in the comments section.

A lawyer dealing with corporate laws, a voracious reader and a keen writer. Satyaroop has a broad experience in the legal and startup industries and has worked with more than 15 companies, startups and legal publications on research-oriented projects. In his spare time, he enjoys reading fiction, biking and playing video games.

![How to Register a Company? [Detailed Guide] company phase registering company](https://www.feedough.com/wp-content/uploads/2017/08/company-phase-registering-company-10.webp)