As a small business owner, once you’ve finally mapped your business strategy, designed an effective logo, and landed your first customer, you’re faced with the question of what next? Now, you must consider your financial situation. And, when you’re starting a business, your income may be completely dependent on the payments you get from your customers. This is when invoices come into play.

But, what is an invoice? It’s nothing but a time-stamped document that includes all purchase-related information and is one of the essential documents you’ll ever generate for your business. Therefore, once you develop an understanding and function of an invoice, you’ll be able to get paid faster, resolve errors and problems more effectively, and manage your products and services more efficiently.

Thus, let’s go through the nits and grits of an invoice to better understand its relevance and applicability in typical transactions.

What Is An Invoice?

An invoice is an accounting document that specifies the items and services a business provides to a customer and establishes the customer’s responsibility to pay for those products and services. Sometimes, sellers also call it a “sales invoice”.

It originated from the French word envoyer, which implies “to send”. Typically, it is a cost breakdown provided by a product or service supplier to the consumer. It includes and defines everything offered or provided by a business and the payment demand and deadline for the customer.

In fact, it is vital for every business for accounting internal controls, and even the audits rely heavily on invoices. But, remember that it’s not the same as a bill.

Difference Between A Bill And An Invoice

As both invoices and bills are documents that contain information about the amount owed as part of a business transaction, many companies and customers use the words interchangeably. However, bills and invoices are not precisely the same. In fact, they are two separate documents with distinct objectives.

An invoice is issued by the business that provides the service, and the customer who receives the invoice records it as a bill to be paid. That is, “A business sends an invoice to a customer, who receives it as a bill, pays the amount owed, and the business issues a receipt as evidence of payment.”

Functions Of Invoice

An invoice is an essential element of communicating with customers. Not only does it assist in speeding up the payment process but it is also used as a source document. Most importantly, it’s used to keep track of all of the company’s sales transactions with the customers. Thus, businesses use invoices for several reasons, including:

For Maintaining Records

An invoice’s most fundamental function is to serve as a record of a sale. It helps to track how much inventory a business has and how much it’ll need in the future. Thus, a seller can use an invoice to examine the entire sales volume and verify the stock balance.

Even the customers can use invoices to keep track of their costs as an invoice gives an organised record of their costs in B2B sales, including itemised information and VAT (if applicable).

For Keeping Track Of The Payments

Invoices make it easier for both the seller and the buyer to maintain track of their payments and the amount owed. It helps them to keep track of when and to whom a product or service was sold, as well as how much it cost. It allows the buyer to know when the seller’s payment is due.

In case of late or missing payment, an invoice supports the official measures that can be made against a debtor to demand payment as a formal request for payment.

For Serving As A Legal Safeguard

The ability to maintain a legal record of the sale is one of the essential features of an invoice. A correct invoice serves as legal documentation of a pricing agreement between the customer and supplier. It defends the seller from any false litigation and defends the company against any possible bogus lawsuits. Thus, it is admissible as evidence in a court of law.

For Simple Tax Preparation

All sale invoices must be recorded and maintained for a business to report its income and pay the correct amount of taxes. Therefore, invoices help to keep track of business income for tax purposes.

For Assisting In Business Analytics

Invoices can assist businesses to gain insight into their customers’ buying habits and identify trends, popular products, peak buying periods, and more. This aids in the development of successful marketing tactics for your company in the long term.

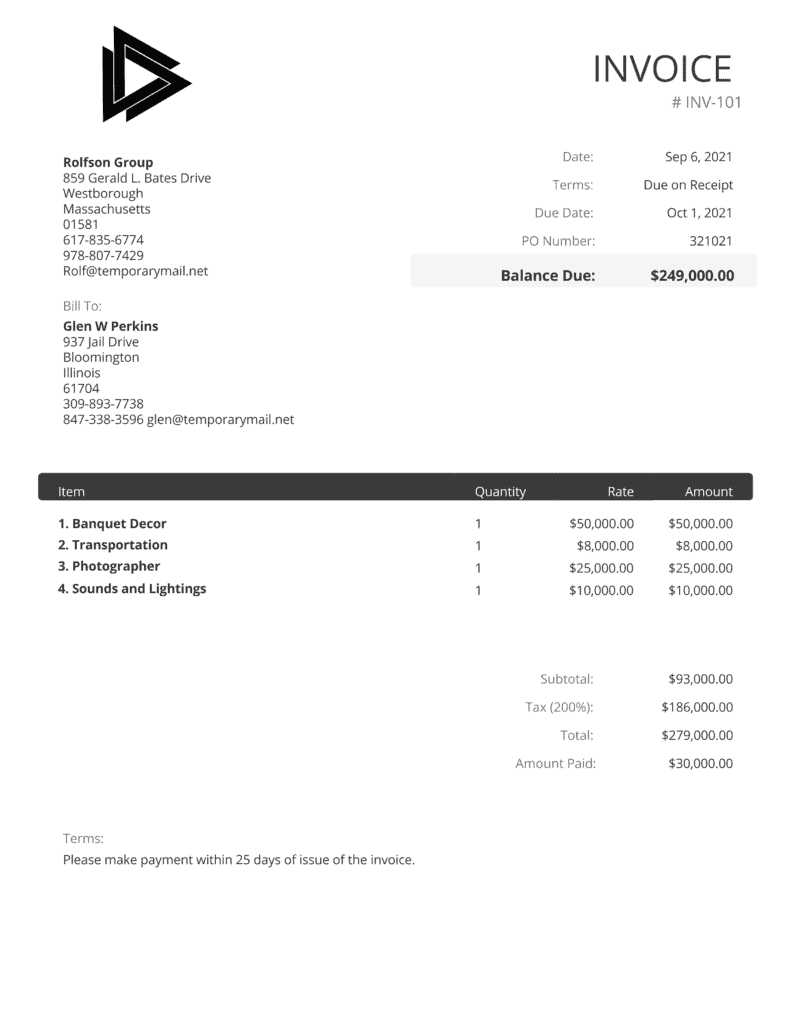

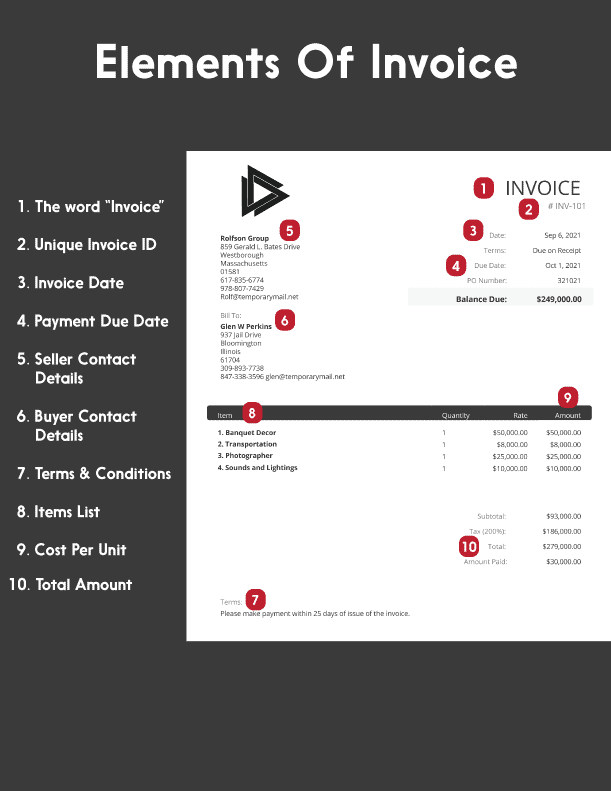

Elements Of An Invoice

A legible, professional, and legally sound invoice should include all of the information a customer will need to make payments as well as a way to contact them if they have any problems. Let’s look at the different components that a business must include on every invoice it issues:

- The word “invoice”: As a header, the term INVOICE should be mentioned in a clear, and professional font. It can also be included along with the business logo and should be prominently displayed on the document so that it can be easily recognised.

- A unique invoice number or ID: Every invoice a business submits should have a unique reference ID, also known as the Invoice number on it. This invoice ID can be a combination of both numbers and letters. Mentioning the Invoice ID is crucial for monitoring purchase records, staying organised and database filing. Thus, businesses should provide a unique number to distinguish various invoices from one another. It’s unnecessary to number an invoice in order, but a business should develop a consistent invoice ID system and ensure they don’t reissue the same invoice number.

- The date: An invoice should contain three sorts of dates: the date on which the goods were sent/delivered, the date of invoice, and the payment due date (deadline by which an invoice should be paid). While the date of supply simply serves to notify when a particular product and service was delivered, the payment due date is far more critical. This is because there is no assurance that a company will get the account receivables if the due date is not mentioned. Also, to guarantee that payments are made on time, the invoice must indicate the date it was sent.

- Contact information: Businesses must make sure to include the names and addresses of their business and the customer. Also, it should be spelt correctly as incorrect spelling causes unnecessary frustration and degrades the customer experience. Including contact details is crucial as if a consumer has a query and isn’t sure how to reach you, they’ll have your contact information. As far as the customer’s information is concerned, it is needed to verify the document’s legality. Suppose you use accounting software to create invoices. All you require are the customer’s email addresses, but you should also gather physical addresses if the customers need an offline copy.

- Terms and Conditions: The invoice must include all of the company’s terms and conditions, including due dates and penalties for non-payment or partial payments. The terms of payment specify the amount of time the buyer has to pay, as well as late penalties and any other payment reductions or costs. These conditions are generally written at the bottom of an invoice to inform the customers of the amount of time they have to pay. For instance, you can specify “net 25 days” meaning that payment must be made within 25 days.

- A detailed list of what you’re charging for: Each product or kind of service provided along with the cost per unit (how much one unit of product costs) of these products must be described on the invoice. Also, don’t forget to specify the taxable amount for the items or services. This is necessary as a comprehensive explanation of product names and quantities will aid in preventing unnecessary misunderstandings between suppliers and customers. Sometimes, the customers may not know what their invoice is for if they don’t have this information, and they may not be able to make payment. Therefore, show where the money that the customer owes came from.

- The total amount owed with currency: This element may appear to be self-evident, yet it plays a significant role in avoiding payment delays. Specify the prices, currency, and total expenses of the purchased products, and don’t forget to include them in the total. Thus, an invoice must clearly state the total amount due for payment.

How To Prepare An Invoice?

The contemporary world has evolved the finest, most convenient, and environmentally friendly method of invoicing, which is done online using accounting and invoicing software. However, if you’re someone who doesn’t want to invest in invoicing software, in that scenario, free invoice templates and generators can help to create invoices online rapidly. We’ve listed a handful of the most basic and successful ways of creating an invoice by format.

Invoice Template

If you want to create simple and professional invoices, then you can use a software template—for example, in Microsoft Word or Excel. Invoice templates are a common method to get started with invoicing as it saves time by eliminating the need to retype the same information every time you create an invoice.

There are many online and offline templates where you can have the option of attaching the invoice to an email or printing and mailing a physical copy. Below are a few free templates.

Template for Microsoft Word

You can use this free template to produce a .docx file. It works with Word 2007 and later.

Template for Microsoft Excel

Here’s a link to a free basic invoice template in .xlsx format. It works well with Excel 2007 or later.

Template for Google Docs and Google Sheets

Invoice Basic has an excellent variety of simple invoice templates for both Google Docs and Google Sheets. Here, once you’ve opened the invoice you want to use, go to File and click “Make a copy…” to generate an editable copy.

Template For Creating Invoice Online

There are sites online like the “Invoice to me” that allows you to produce a basic invoice. When you use the tool, it remembers your information so you can create invoices faster in the future.

Invoicing And Accounting Software

Many different types of online invoicing software are available today that make it simple to produce and send invoices. These modern SaaS invoicing software allows you to automate, speed up, and manage the invoicing process so that you can be paid on time. For instance, Freshbooks is an invoicing software that lets you choose an invoice template, edit it with the essential information, submit it, and be paid in minutes

Paper Invoice

Some business owners prefer excluding computers from the process of creating an invoice entirely. In such situations, one can always use a paper invoice form. These are sold in pads and are available at most big office supply retailers.

Types of Invoices

There are various types of invoices a business can prepare depending on their customers and projects. However, one thing to be kept in mind is that while invoices may differ, the components, as discussed before, are the same and must be included in each invoice type.

The following are the most often used invoices in the business:

Pro-Forma Invoice

A pro forma invoice is a document that outlines the seller’s commitment to providing products and services to the customer at a predetermined price. It is more of a projection of how much a particular project will cost after it’s completed than a payment request. Thus, it gets the customer ready for the amount they’ll have to pay later. Also, the pro-forma invoice is not the final charge, and it may vary once the project is completed.

Commercial Invoice

A commercial invoice is a document that is used when your company sells a product or service overseas. This invoice contains additional information needed to cross the border, such as the nation of origin, shipping date, shipping quantity, volume, packing type, product descriptions, payment method, and machine parts to validate typical worldwide transactions.

Credit Invoice

Businesses send a credit invoice, also known as a credit memo, when customers request a discount, refund, or make corrections in prior invoices. A credit note is often provided to the customer if products are returned due to damage or errors.

It’s important to note that a negative total number will always appear on a credit invoice. For example, if a client requests a $100 refund on a certain product, the credit invoice will show -$100 as the displayed number.

Timesheet Invoice

The Timesheet Invoice is used to charge customers based on the number of hours employees spend on their projects. The Quantity field on the Timesheet Invoice is populated with all of the employee’s approved hours. The Price section displays the project’s customer charge rate per employee.

This form of invoicing is most commonly used by psychologists, business consultants, creative agencies, and lawyers in intellectual professions rather than technical ones. Rental services, such as car, costume, or culinary equipment rentals, are frequently invoiced using the timesheet invoice.

Recurring Invoice

Businesses that charge consumers the same price for ongoing services, such as memberships or subscriptions, generate recurring invoices. It’s essential for all SaaS as it minimises account receivable risks. In fact, even the customers benefit from recurring invoices since they have to sign up and provide payment information only once.

Usually, businesses that supply monthly package services, such as IT software or social media marketing solutions, prefer this form of invoicing.

Past Due Invoice

Businesses issue a past due invoice as a method to renew the payment if the payment deadline (specified in the initial invoice) has passed and your customers fail to pay their bills on time.

A past due invoice contains all of the information included on a regular invoice, plus any additional late fees. After the clients miss the payment deadline, the past due invoice should be delivered. Interest charges and late fees are also included, in addition to the services purchased and overall prices.

Final Invoice

As the name suggests, the final invoice is the last invoice given to your clients once a project is done to request payment. This invoice is more thorough than the Pro-forma invoice since it notifies the customer and contains a full description of the services given as well as the overall cost.

Thus, it’s vital to have an understanding of the fundamentals of invoicing in order to put the process into motion. The ideal approach to avoid extra efforts and get optimal results is to use current technology, such as online invoice generators or e-invoicing.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of this article on what is an invoice in the comments section.

An avid reader and economics enthusiast who is always eager to learn. Prachi is an aspiring leader who believes in what she does. Besides reading , she is fond of baking , dancing and travelling.