Funding is the key to success in any business. And when it comes to startups, it’s the water to their seed (the idea), the fuel to their engine (the team), and the foundation on which they build their success.

As a startup, having enough funding is essential to keep your business running and thriving. Without adequate capital, you may struggle to cover your overhead costs, develop new products or services, and expand your market reach.

Nearly 30 per cent of startups fail due to inadequate funding. And you wouldn’t want to be one of them. So, how can you secure the necessary seed funding for your startup?

Here’s a guide elaborating on the different sources of seed funding, the types of seed funding, and how to get seed funding for your startup.

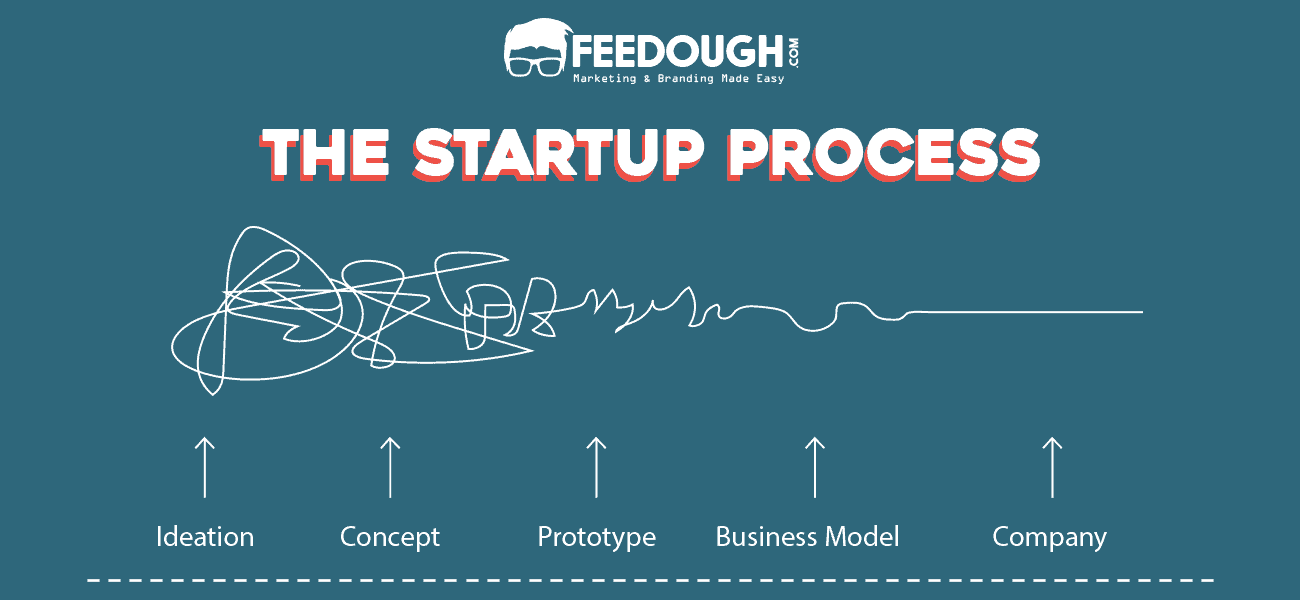

What Is Seed Funding?

Seed funding is the initial capital raised by startups to help them get established and develop their business plans. It’s considered a critical stage in a startup’s journey, as it helps them turn their idea into a viable business.

The term “seed” refers to the seed that grows into a plant; similarly, seed funding plants the foundation for your startup to bloom into a successful venture. It’s usually a smaller amount of money compared to other funding stages, such as Series A or B.

Here’s an example. Suppose you have an idea for a new app that helps people find local farmers’ markets. Right now it’s just an unpublished app on your phone, but you think it could be profitable if more people knew about it. You need money to hire developers and designers to help bring your idea to life, so you seek out seed funding.

When Do You Raise Seed Funding?

In simplest terms, a startup needs seed funding to fulfil the following purposes –

- Setting up the business – Establishing your startup by incorporating it and paying for legal and operational costs.

- Initial operating expenses – Purchasing equipment, developing a prototype, hiring essential team members.

- Early-stage development – Conducting market research and testing out the product or service.

- Marketing and advertising – Spreading awareness of your business to attract customers.

- Team growth – Hiring employees to expand your team and take on more responsibilities.

Know that seed investment is different from pre-seed investment. Pre-seed funding usually focuses on converting the idea into an actual product, while seed funding is for converting the product into a business.]

Do you need a Seed Investment?

Not everyone in the business will need seed funding. For instance, if you’re a solopreneur providing consulting services, you may not need to secure seed funding. Even investors will not be too interested in investing in a small business unless it’s scalable and has the potential for high returns.

So, when is seed funding needed?

- When you have a disruptive idea or prototype but need help bringing it to market: For example, you have a design for an eco-friendly water bottle but need funds to produce and market it.

- When your startup requires more funds than just personal savings or revenue from early customers: If your business idea requires significant capital to get off the ground, seed funding can help bridge the gap until you’re ready for larger rounds of investment.

- When you have initial (though little) traction: Traction refers to the early signs that your product or service is gaining interest and customers. If you can show potential investors that your idea has gained some traction, it can increase their confidence in investing in your business.

Types of Seed Funding

Seed funding isn’t always similar to the money-for-equity deal like what they show in shows like Shark Tank.

In your search for seed funding, you’ll come across several types of investments with amounts ranging from $100,000 to $5 million. These investments often involve three types of contracts: Equity funding, debt funding, and convertible debt.

- Equity Funding: With equity funding, investors provide capital in exchange for ownership equity in your company. This means they become shareholders and hold a proportional stake in your company’s success and profits. Equity funding allows you to access the necessary capital while sharing the financial risks and rewards with investors.

- Debt Funding: Debt funding involves borrowing money from investors with the promise to repay the loan plus interest. Unlike equity funding, investors do not become owners in your company but hold a legal right to receive repayment of their investment. This type of seed funding is commonly used for startups that have a clear path to profitability.

- Convertible Debt: Convertible debt is a hybrid form of financing combining equity and debt funding elements. Initially, it starts as a loan but can later convert into equity based on predetermined conditions such as a future funding round or specific milestones. Convertible debt offers immediate capital without the immediate need to determine your company’s valuation. If the loan converts, it gives investors the potential for equity, giving them the growth potential of an equity investment. This option provides you with more flexibility in the early stages of your startup. There are several modified versions of convertible debt, such as SAFE (Simple Agreement for Future Equity) and KISS (Keep It Simple Security), which have specific terms and conditions tailored to startups.

Sources Of Seed Funding

There isn’t just one source of seed funding for startups. You have several options to choose from, depending on your business model, industry, and funding needs. Each source has its unique advantages and disadvantages, so it’s essential to evaluate each one carefully before making a decision. Some of the common sources of seed funding include:

Angel Investors

Angel investors are high-net-worth individuals who invest their personal funds in startups. They usually have experience in entrepreneurship and can provide valuable advice and connections to help your business grow. Angel investors typically invest smaller amounts compared to venture capitalists but tend to be more hands-on with their investments.

Angels are probably the most popular source of seed funding for startups as they are more willing to take risks and invest in early-stage companies.

However, securing funding from an angel investor can be challenging as they often receive hundreds of pitches and only invest in a small percentage.

To find angel investors for your startup, you can –

- Use websites like AngelList to connect with potential investors

- Attend startup events and pitch competitions to network with angels

- Leverage your personal network and ask for referrals to potential investors

Once you have identified a few potential investors, make sure to thoroughly research their investment portfolio and approach them before pitching to them. You can even reach out to founders who have received funding from these investors and ask for their experiences.

Venture Capitalists (VCs)

A venture capital firm is an investment fund managed by professionals who specialise in allocating funds on behalf of various investors. Such funds provide startups with seed funding in exchange for convertible debt or equity ownership. VCs invest other investors’s money.

To attract venture capital funding, you need to create a good startup plan, develop a scalable business model, and assemble a strong team. Attend relevant industry events and conferences where you can make connections with VCs. Seek introductions from your network to engage with VCs who may be interested in investing in your startup.

However, it’s important to note that VCs can be highly thorough in their evaluation process. You can anticipate multiple meetings and the involvement of various stakeholders as they meticulously scrutinise your startup.

VCs usually prefer references but almost all of them have websites with forms for startups to submit their business plans. You would have better chances of securing VC funding if you could provide solid evidence of revenue growth potential, scalability, and market demand for your product or service.

Bank Loans

Unlike VCs and angel investors, banks don’t invest in your startup. Instead, they provide loans with the expectation of receiving interest on that loan.

Moreover, it’s difficult to get a business loan from a bank if you’re just starting out, as banks usually require collateral and evidence of profitability. This can be challenging for startups that are still in their early stages.

However, if you have a good credit score and a well-established business with steady revenue and strong financial projections, you may have a higher chance of securing a bank loan for your startup.

If you don’t have a good credit score, certain non-banking financial institutions provide personal loans with no credit check, but at a higher interest rate compared to traditional bank loans. These lenders evaluate other factors, such as income, employment history, or collateral, instead of focusing solely on credit scores. This means that even if your credit score is not favourable, you still have the opportunity to secure seed funding for your startup.

Besides this, certain banks have special programs for startups, such as Small Business Administration (SBA) loans. These loans are partially guaranteed by the government, making it less risky for the bank to lend money to startups.

However, it’s important to note that taking a loan from a bank means you will have to pay interest and make repayments according to a set schedule. This can add financial strain on your startup, especially if you have not yet established a steady stream of revenue.

Crowdfunding Platforms

Crowdfunding refers to the practice of collecting small amounts of money from a large number of individuals for a specific project or cause. It has become an increasingly popular method for startups to raise funds, as it allows them to showcase their business idea and gain support from potential customers and investors. There are various crowdfunding platforms available, such as Kickstarter, Indiegogo, and GoFundMe, which offer different types of funding models such as:

- Reward-based: Backers receive a product or service in exchange for their contribution. For example, a tech startup may offer its new product to backers before it is released to the general public.

- Equity-based: Backers receive a share of ownership in the company in exchange for their investment. This type of crowdfunding is regulated by the Securities and Exchange Commission (SEC) to protect both the company and investors.

- Donation-based: Contributions are made without any expectation of receiving anything in return, typically for charitable causes or social impact projects.

Crowdfunding can be a great way to not only raise funds but also validate your business idea and generate buzz around your startup. However, it requires a well-planned campaign and effective marketing strategies to attract potential backers.

Friends, Family, And Fools

FFF is a term commonly used in the startup world to refer to the three main sources of initial funding for a new business – friends, family, and fools. These are typically the first people that entrepreneurs turn to when they need capital to get their startup off the ground.

Friends and Family: The first people that you may reach out to for funding are your friends and family. These are the people who know you best and believe in your potential, making them more likely to invest in your business. However, it is important to consider the dynamics of personal relationships and set clear expectations when accepting investments from friends and family.

Fools: The term “fools” refers to investors who take on a high level of risk by investing in your startup, often without fully understanding the business or industry.

Even though it may be tempting to accept funding from family and friends, you should carefully consider the potential risks and implications of mixing personal relationships with business. It is important to have open and honest communication, set clear expectations, and formalize any investments with proper legal agreements.

Incubators

A startup incubator is a not-for-profit organisation that helps startups with resources and guidance to develop their business ideas. They usually provide a physical workspace, mentorship, networking opportunities, and access to funding.

Their main goal is to help you turn your idea into a successful and sustainable business. Often, reputed incubators are associated with universities or industry organisations, providing startups with a strong support system and access to valuable connections.

Additionally, being part of an incubator program can also increase the chances of receiving funding from investors as they tend to have more confidence in businesses that have been vetted by established incubators.

Some popular startup incubators include Idealab, CodeBase, and DMZ . They have a competitive application process, but if accepted, startups can benefit greatly from the resources and support provided.

Accelerators

Startup accelerators are for-profit organisations ideal for startups like yours that want to achieve rapid growth within a shorter timeframe. These programs are similar to incubators but cater to more established startups.

The main objective of an accelerator is to help you scale your startup and enter the market quickly. They offer structured programs that often run for three to six months. These programs provide you with an intensive curriculum covering various aspects of your startup, including market validation, strategy, product development, marketing, and fundraising.

Generally, accelerators may also offer a small amount of seed funding in exchange for equity in your startup.

Some well-known accelerators include Y Combinator, 500 Startups, Techstars, and AngelPad. These programs have a rigorous selection process and attract a large number of applications from around the world. If accepted into an accelerator program, your startup will receive mentorship,

Government Grants and Programs

Some governments and public organisations offer entrepreneurship grants or subsidies to early-stage startups as a way to foster innovation and economic growth. These grants can provide non-dilutive funding, meaning you don’t have to give up equity in exchange for the funds.

Look at government grants or programs that are made to help startups in the early stages. Look into the funding options available in your area and check if your startup qualifies. Make a strong grant proposal that fits with the goals of the program and shows how your startup can make a positive difference.

How To Increase Your Chances Of Successfully Securing Seed Funding

Seed funding can be highly competitive, and there are no guaranteed ways to secure it. However, there are some strategies that you can use to increase your chances of success:

- Network: Attend startup events, conferences, and workshops to meet potential investors and build relationships with them.

- Create a strong pitch deck: A compelling pitch deck is essential for securing seed funding. Make sure it effectively communicates your startup’s vision, value proposition, and potential for growth.

- Focus on traction: Investors want to see that your startup has real-world validation in the form of customers or users. Prioritize building a strong customer base or user following to increase your credibility with investors.

- Leverage your team’s expertise: Highlight any relevant experience or expertise that you and your team members bring to the table. This can help investors see that your team has the necessary skills and knowledge to make your startup successful.

- Get mentorship or join an accelerator program: Mentorship from experienced entrepreneurs or participation in an accelerator program can provide valuable guidance and connections to potential investors.

- Be persistent: Securing seed funding can be a lengthy process, so it’s important to be persistent and not get discouraged by rejection. Keep refining your pitch and seeking out new opportunities.

- Understand the criteria of potential investors: Research the investors you are targeting and understand their investment focus, sector preference, and past investments. This can help you tailor your pitch and increase your chances of success.

Having a validated MVP is almost a prerequisite for securing seed funding. This not only shows that your product or service has been tested and proven, but it also demonstrates your ability to execute and deliver results.

Another important aspect is to have a strong and scalable business model. Investors want to see that your startup has the potential for long-term success and profitability. This can include factors such as a competitive advantage, market demand, and scalability.

FAQs

Typically, the process of opening and closing a seed round of funding takes approximately three to six months. The timeline’s duration will vary based on factors such as the market, your specific business, the quality of your pitch, and other relevant factors.

For seed funding, there are no technical requirements. You can secure financing with just an idea or even with a working prototype of your product. It’s a good idea to start by having a product MVP, clearly understanding your target market, and assembling an initial team.

After seed funding, a startup typically progresses to Series A funding. This stage is crucial for companies that have developed a track record, showcasing initial traction, user growth, or consistent revenue and are ready to scale their operations. Series A funding is aimed at optimizing product offerings, expanding market reach, and increasing operational efficiency. Investors at this stage usually include venture capital firms, and the funding amount is larger than seed funding, reflecting the increased valuation of the company and the higher expectations for growth and scalability.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)