What if Feedough changed its business model into a subscription-based business model where you’re offered 3 different plans to choose from –

$5 per month – access to just business models articles on Feedough

$9 per month – access to all articles on Feedough

$10 per month – access to all articles plus team Feedough provides you with the consultancy service.

Which one will you choose?

If you chose the $10 plan then we’ve succeeded in employing the decoy effect to alter your decision-making process. Fret not, it’s not just us. This bias is employed in various fields such as finance, purchasing and even politics.

But what exactly is the decoy effect and how can you implement decoy effect for your benefit?

Read on to find out more.

What is the Decoy Effect?

Decoy effect is a phenomenon in which a given setup of two options, a third asymmetric choice is provided to tip the balance in favour of a specific entity.

In simple terms, when given two choices, a person would make a particular decision based on his/her personal preference but when given a strategic decoy option, he is very likely to change his original decision.

Let’s look at an experiment conducted by National Geographic to understand this better.

Given a multiplex, people were segregated in two groups.

The first group was given only two choices in popcorn; a small bucket of popcorn for $3 or a large one for $7.

The second group was given three choices; a small bucket for $3, a medium bucket (the decoy) for $6.5 and a large one for $7.

The experiment revealed that the first group rationally chose the small bucket of popcorn as the large bucket was considered a rip-off. However with the second group, due to the decoy, consumers opted for the large bucket of popcorn.

Decoy Effect in Real Life

Companies rampantly use decoy effect to boost their sales. Let’s look at the following three cases where the decoy effect has been employed.

Decoy Effect In Pricing The Products

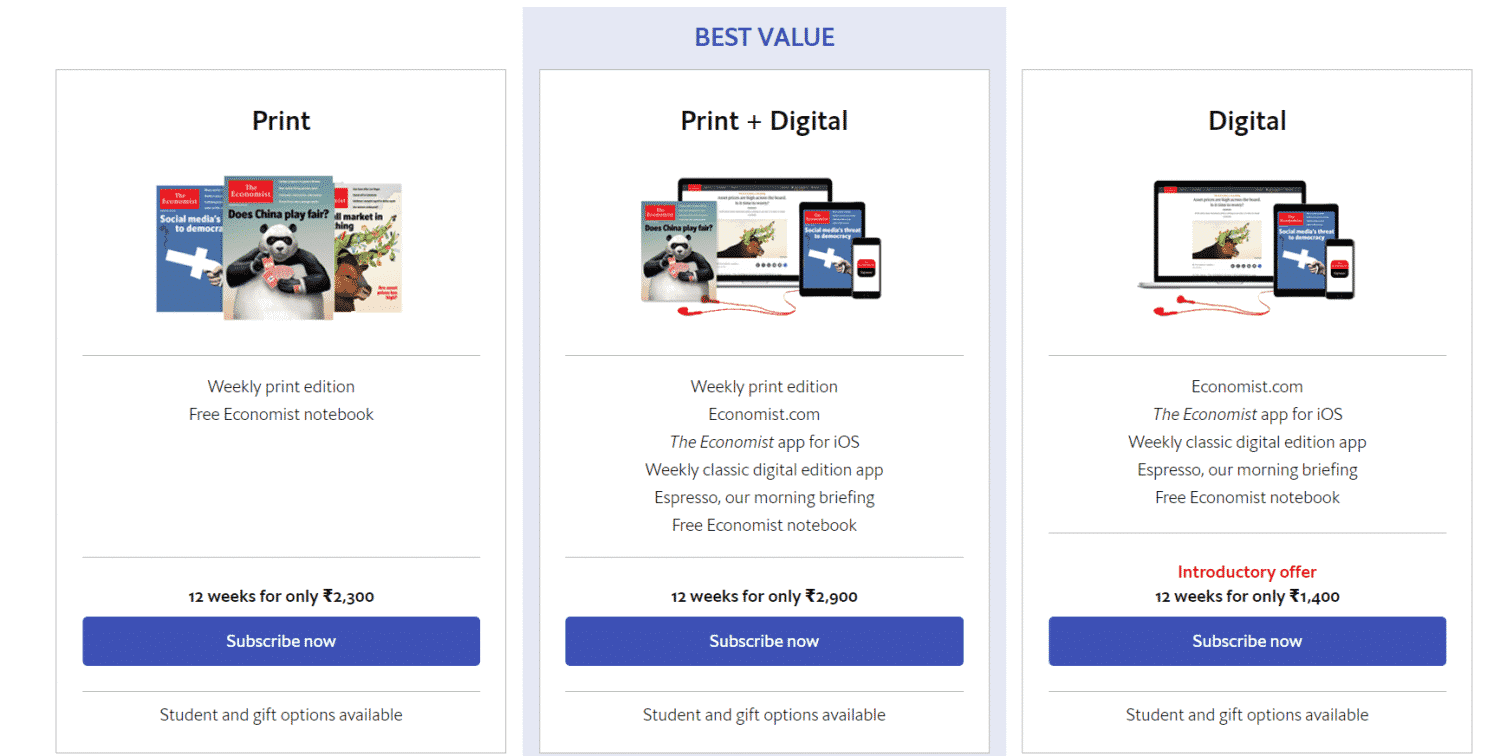

If you were to see only the two plans above you would make a reasonable choice according to your needs, and in this digital age people would likely prefer the digital option which is cheaper, but it does not boost the sales of the venture.

So the next step is to introduce a strategic decoy which is priced higher than the digital version and slightly lower than the digital+print plan and, lo and behold, consumers who would have bought a print version are now more inclined to purchase the digital+print plan since it offers more flexibility.

Decoy Effect In The Stock Market

Decoy effect could also be used to influence the decision in financial markets. An extensive study based on gender, IQ and other parameters were carried out by Brittany Paris of the University of New Hampshire. In the study, the main focus was on how investors could be influenced to choose one aspect of a stock over another in different scenarios.

The first group was only given two choices with

Stock A: long-term growth of 30% and a dividend yield of 3%.

Stock B: long-term growth of 20% and a dividend yield of 6%.

The second group of investors were given three stock choices with the following features.

Stock A: long-term growth of 30% and a dividend yield of 3%.

Stock B: long-term growth of 20% and a dividend yield of 6%.

Stock C: long-term growth of 25% and a dividend yield of 2%. (The decoy)

The third group was given the following choices.

Stock A: long-term growth of 30% and a dividend yield of 3%.

Stock B: long-term growth of 20% and a dividend yield of 6%.

Stock D: long-term growth of 18% and a dividend yield of 4.5% (The decoy).

In the case of the first group, investors chose according to their personal preferences.

With the second and third groups, a major shift in behaviour was seen. The second group investors chose a Stock A due to its dominance over Stock C and B while the third group of investors chose Stock B due to its dominance over Stock A and Stock D regarding yield.

How Do You Use The Decoy Effect?

- Choose a plan or item you want to sell more of.

- Provide them with three options since if you offer two choices, the customer will choose according to their preference and if you give more than three, then you will make the customer face choice overload dilemma.

- Create an imbalance in the choice. The goal is to create a decoy. It should not happen that a decoy is preferred more in the new situation. For this reason, the decoy should look like a stupid option. You want there to be some imbalance.

- Price the decoy close to the option you want to sell more and marginally better than the low-priced option

- Be aware of the middle-choice tendency. People tend to choose the middle option when presented with three options because of our bias towards the central figure in a group of three. As you saw in the pricing of the economist pricing page, the plan that the company wants the user to buy the most is placed in the centre.

Bottom Line?

The decoy effect is subtle, yet present everywhere.

It affects your consumption habits, and with careful observation, you could use decoy effect to grow your business as well be careful when making important financial decisions.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on the decoy effect in the comments section.

An experienced developer and tech entrepreneur. Kanishk loves to write about machine learning, entrepreneurship, and tech trends.