There are thousands of firms competing with each other extensively. These companies use different kinds of tools like PEST analysis, BCG Matrix, Porter’s 5 Forces and Value Chain analysis to analyse the internal and external environment. A vision statement is the first step in the basic strategic process of any firm. It is followed by objectives, internal & external analysis, strategic choices and strategic implementation. These processes help the firms to understand their business enterprise and identify opportunities and shortcomings in their firm.

What is VRIO Framework?

VRIO Framework is a business analysis framework tool used to analyse the internal resources and capabilities of the firm. The development of this framework tool started in 1991 by Jay B Barney in his work ‘Firm Resources and Sustained Competitive Advantage’. In this book, he pinpointed four factors that contribute to a firm’s resources to become a source of sustained competitive advantage. Originally this framework was called VRIN. He improved VRIN framework in 1995 in this later work, ‘Looking Inside for Competitive Advantage’ and named it VRIO.

Irrespective of the business model, VRIO is used as a framework to evaluate the capabilities and resources of the firms like financial, human, material and non-material resources and capabilities. Each word in VRIO denotes the four framework questions asked about a resource or capability to determine its competitive potential:

The Question Of Value

Looking at the resources of the firm, the question to be asked first is if the resources are efficient enough to exploit a hole or weakness and alleviate a threat in the marketplace. These resources are termed as valuable resources and are a strength of the firm. Resources are also said to be valuable if they help the firms to grow perceived customer value. This is achieved by increasing differentiation and decreasing the price of the product. If the resources can’t exploit any weakness or help with the survival of the firm, it is considered as a weakness. While many resources are valuable in every industry, there are resources which are a strength for one industry while at the same time, a weakness for another.

Demographic change, technological change, economic climate, cultural change, legal and political conditions and specific international events are some resources which can be exploited efficiently. The threat of suppliers, the threat of substitutes, the threat of buyers, the threat of rivalry and the threat of entry are some threats which the above resources can alleviate. By looking into the value chain of a firm, valuable resources, as well as capabilities, can be identified where each business creates its services and products step-by-step. The choices a firm make with respect to the value chain makes it an important tool in identifying the resources and capabilities.

The Question Of Rarity

Resources and capabilities that are unique and obtained by only a few firms are said to be rare. Getting a rare resource is quite difficult for a firm but it is extremely valuable when it gets one. Having rarity in a firm leads to a competitive advantage over other firms. There are two conditions to be satisfied for rarity to hold a competitive advantage in a firm. The resources and capabilities must be really hard to find and they should last longer while their supply is always short.

When a situation arises where more than one firm has the same resource or capabilities and use them in a similar way, it leads to competitive parity. There is no competitive advantage since the rarity factor does not exist in these cases. Losing valuable resources and capabilities would damage a firm because they are crucial for staying in the market

The Question Of Imitability

Some resources, as well as capabilities of one particular firm, can be imitated by other firms which lead to lack of originality of the original product. Firms with rare resources and capabilities that are hard to imitate by other firms gain a competitive advantage in the marketplace. It can also gain a competitive advantage by utilising its rare resources to neutralise any threats or exploit any opportunity.

When this competitive advantage is discovered by other firms, the response by them is in two different ways. Either they will ignore the competitive advantage of the rival firm and its gains to operate normally or they will try to discover and duplicate the strategy used by the rival firm. The level of imitations by other firms depends on the cost factor also. If the cost of acquiring the resources is less or negligible, the firms will try to imitate the competitive advantage to gain competitive parity.

Imitations can be done in two major ways. Direct duplication occurs when a firm can directly imitate the resources or capabilities of a rival firm while the firms try to substitute for the resources or capabilities if the cost of imitation is high.

The three reasons why resources and capabilities are hard to imitate are

- Historical conditions: Resources and capabilities were developed from historical events or milestones in the historical timeline and over a longer period which are usually costly to imitate.

- Causal ambiguity: Firms that imitate the resources and capabilities can’t identify or tell the elements that lead to the cause of competitive advantage.

- Social Complexity: The resources and capabilities involved in the firm are based on the firm’s culture or interpersonal relationships.

The Question Of Organisation

Organising the firm to exploit the resources and capabilities is the last step in the VRIO framework. The company’s formal reporting structure, management control systems and compensation policies are a few factors which decide the organising of the firms. Who reports to who is denoted by formal reporting. Management control systems denote both formal and informal ways to always ensure the manager’s decisions align with the firm’s strategies. While a formal control system consists of reporting activities and budgeting, informal controls include the firm’s traditions and let employees check on each other. Compensation policies let firms give incentives to their employees to motivate them and make them work harder. Stock increases, bonuses as well as salary increase are some monetary incentives while extra holidays or bigger offices are some non-monetary incentives.

Firms with valuable, rare and expensive to imitate resources and capabilities can suffer competitive disadvantage without a correct way of organisation. The firms should arrange its policies, processes, organisational structure, management systems, and traditions to fully realise their potential to achieve sustained competitive advantage.

How Does VRIO Analysis Help Firms?

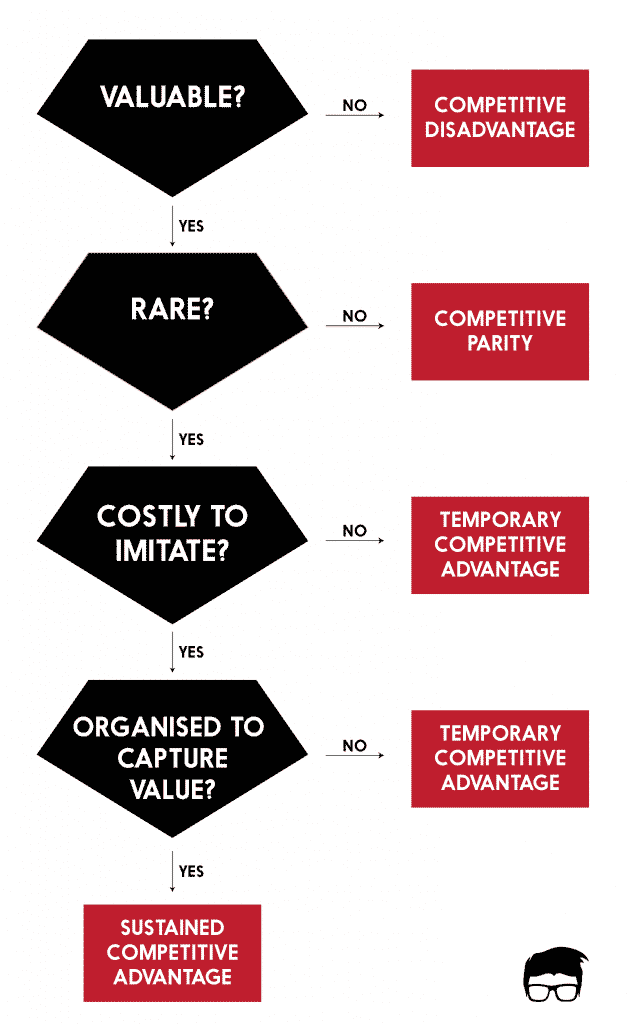

VRIO analysis is complimentary to PESTEL analysis which assesses macro-environment. The following analytical statements are taken into consideration by the firms, after which it gets an idea about the position of their firm.

If the resource is not valuable, then it should be outsourced as it is of no use to the firm.

If the resource is valuable but not rare, then the firm is in competitive conformity. It means that even though the firm is performing badly, it is still better than its competition.

If the resource is valuable and rare and not expensive to imitate it, then the firm has a temporary competitive advantage. But, if in the future, other firms try to imitate, then the competitive advantage is lost.

If the resource is valuable, rare and is expensive to imitate it but the firm is not able to organise them, the resource becomes expensive for the firm.

If the firm can manage the advantages and are able to organise the firm and change the temporary competitive advantage, it becomes a permanent competitive advantage.

The advantage of a VRIO analysis is its simplicity and clarity. Almost every firm uses VRIO analysis in combination with other analytical techniques to help evaluate business resources and capabilities in a more detailed view. For financial resources, there are many detailed financial indicators that assess the financial condition or performance of the firm from different perspectives. In the same way, human resources, information or property are other detailed indicators of their performance, quality or efficiency.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on VRIO Framework in the comments section.

A startup enthusiast who believes anything can be built if you do that required research and get the base ready.