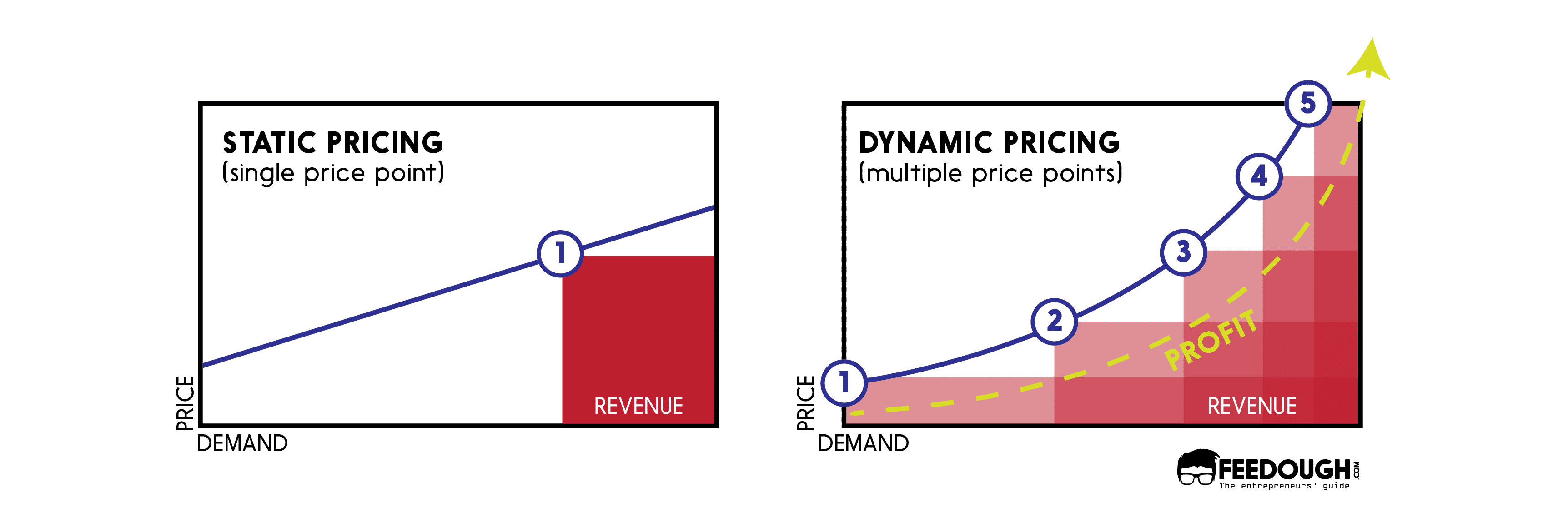

Choosing the proper pricing strategy is one of the most important undertakings for any business because any error in the setting of the price directly results in lost profit. But even when the proper price is set, it doesn’t take into account the changing market conditions and change accordingly.

Enter dynamic pricing.

What is Dynamic Pricing?

Dynamic pricing (also called real-time pricing, surge pricing, or time-based pricing) is a technique that focuses on setting the price of the product taking into account different factors such as demand & supply, inventory, competition, locality, and other market conditions but in a smaller time frame.

Once you’ve obtained market readings, you can then fix the price accordingly to achieve better profit margins than just leaving the price as is when it was first launched.

You would have experienced this before on a lot of e-commerce. E-commerce sites like Amazon, Alibaba, Taobao, Walmart, eBay, and Target use this strategy effectively, changing the prices of the products depending on the demand and availability on-the-fly.

But, keep in mind –

The dynamic pricing strategy is not to be confused with other pricing strategies like differential pricing. Differential pricing refers to the pricing of the products based on the customer’s behaviour and characteristics, such as previous purchases and spending ability. On the other hand, dynamic pricing refers to the setting of pricing according to market conditions and similarly related factors.

All this might seem to favour the businesses more than the consumers, but that doesn’t cover everything in its entirety.

This brings us to –

The advantages and disadvantages of using dynamic pricing.

Advantages | Disadvantages |

|---|---|

Higher profit and sales | Customer dissatisfaction |

Adjusting to the competition | Loss of sales |

Flexibility | Gaming the system |

Better inventory management | Not applicable everywhere |

Demand reflective pricing | Price fluctuation |

Advantages of Dynamic Pricing

Higher Profits & Sales

Dynamic pricing is really useful since it provides a venue for you to gain more all while selling more. With the use of dynamic pricing, you get to increase prices on the products whose demands have risen – netting you more profits and sales. This, though, is the ideal use and dynamic pricing can be used to boost either – profit or sales – quite well.

Adjusting to the Competition

Dynamic pricing can help you beat the competition quite easily. You can take the shopping preferences of your customers to provide a better experience but at a cheaper price compared to your competitors pricing all thanks due to dynamic pricing. This helps in bringing a lot more than just customers – it helps drive sales even while there are a lot of competitors in the market.

Flexibility

By implementing dynamic pricing, your business stands to benefit by remaining profitable. This provides flexibility and freedom to focus on other aspects of the business. Dynamic pricing provides the ability to focus on different sources of revenue while breaking even during the harshest of times. In many cases, this flexibility and freedom help make or break business operations.

Better Inventory Management

Dynamic pricing helps provide indirect control over the inventory – allows you to provide discounts for overstocked products to reduce their numbers or have a higher price on higher demand items to maintain the supply chain while earning more revenue. This helps in maintaining the flow of the inventory even during the toughest of times.

Demand Reflective Pricing

Dynamic pricing reflects the actual demand in the market. This is beneficial for the business with limited supply as it can make the most out of increasing demand.

Similarly, low demand can benefit customers, in the form of low prices, for ordering from the business during a dull-sales period.

Disadvantages of Dynamic Pricing

Customer Dissatisfaction

Dynamic pricing on products means that customers purchasing the same product but at even slightly different times means one ends up paying more than the other. This tends to upset customers who had to pay a higher price. Dynamic pricing is a double-edged sword – the customer who got the same product at a lesser price might come to trust your brand. But those on the other end can end up becoming hostile towards your company, which tends to reduce your brand image and brand value.

Loss of Sales

While dynamic pricing may help you gain higher profit margins all the while increasing sales, if not implemented properly, it could also lead to loss of sales and customers. In case a customer comes across the same product but priced significantly lesser by another seller, you will definitely not stand to gain from using dynamic pricing.

Gaming the system

Shoppers are more tech-savvy than ever. They have figured out methods and tools that can help them beat the changing prices – the tools and services provide consumers with the list of the prices of the same product from different sellers. This helps them find the cheapest of deals and negates all the steps in place for retaining a customer since they don’t care about the brand anymore – just the pricing alone. Shoppers are aware that companies tend to use dynamic pricing algorithms to set their rates and hence use ingenious methods such as using private browsers for product research, which helps limit the amount of information collected by them. This helps defeat the dynamic pricing algorithms since they tend to work by raising the prices on products with increasing search volume.

Not Applicable Everywhere

Dynamic pricing is a strategy that works better in certain fields and industries than the others. This may be attributed to the fact that some fields of businesses tend to prioritize customer satisfaction than just straight up chasing profit margins – this leads to a better brand image when implemented properly.

Price Fluctuation

Using dynamic pricing can cause significant price fluctuations in the market segment – a competitor may lower their price, planning to make back in volume, in case you increase your prices. It may also backfire in case you lower your prices and the competition reduces their prices even lower.

Dynamic Pricing Examples

Transportation

The airlines and ride-sharing industry are some of the earliest adopters of dynamic pricing. Take the example of an airline ticket. The ticket for the exact same flight with the same destination has different prices during different times of booking. One may get a cheaper ticket if they book it months earlier from the departure date while the other may have to pay higher prices if they were booking it just days before departure.

The ride-sharing and hailing services also follow a similar method – Uber is a great example in terms of implementing dynamic pricing for their rides.

Uber Dynamic Pricing

Uber uses dynamic pricing to change their prices when there is heavy load, demand or traffic or lesser number of drivers accordingly. You might find that the price is different for the same trip that you took a few days earlier – this is because Uber uses its very own dynamic pricing algorithm to adjust its rates based on different factors, such as time and distance of your route, traffic and the current rider-to-driver demand.

e-Commerce

e-Commerce companies are the major users of dynamic pricing. This is because –

- It is much easier to implement such strategies.

- Easier to obtain data that can help provide personalized pricing and rates.

- It can be used for any product on sale.

Let’s take Amazon for example.

Amazon Dynamic Pricing

Amazon has always used dynamic pricing to their advantage – it has adjusted the prices of their products based on market demand. This has helped them beat competition all the while increasing sales and revenue. It is a win-win for Amazon since it doesn’t take much for it to implement this on the vast majority of products that it offers. Amazon has usually relied on automated software to help set and change their prices based on inventory, competition, and other factors accordingly. This also helps them increase their brand value and recognition among consumers.

Entertainment

The entertainment industry is another field where dynamic pricing is used to the maximum extent. Take the example of music concerts – they tend to increase their ticket sales with the use of clever dynamic pricing. Initially, they keep the prices low and raise them as the concert dates come near. This strategy initially helps increase awareness and demand among the ticket buyers and the concert folks can then increase the prices on their tickets as the demand rises, more than making up for and bringing a lot more in return.

Final Thoughts

Dynamic pricing is an essential strategy and one stands to gain a lot in return if implemented well. The main takeaway is that dynamic pricing works well if and only if implemented properly.

Dynamic pricing helps indirectly control various aspects of sales and allows for a lot of creativity. There is an unending number of ways that data can be used to influence price using big data and machine learning.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on dynamic pricing in the comments section.

Started out to become a developer but felt at home in the home of startups. The journey started from a single novel. Been an entrepreneur since schooling days. Interested in coding, reading and movies.