What if charging sellers hefty commissions isn’t the only way to build a billion-dollar e-commerce empire? While Amazon and Flipkart rake in profits from commission fees, one Indian startup decided to flip the script entirely.

Meet Meesho – the platform that’s rewriting e-commerce rules by doing something most competitors thought was impossible: letting sellers keep 100% of their earnings.

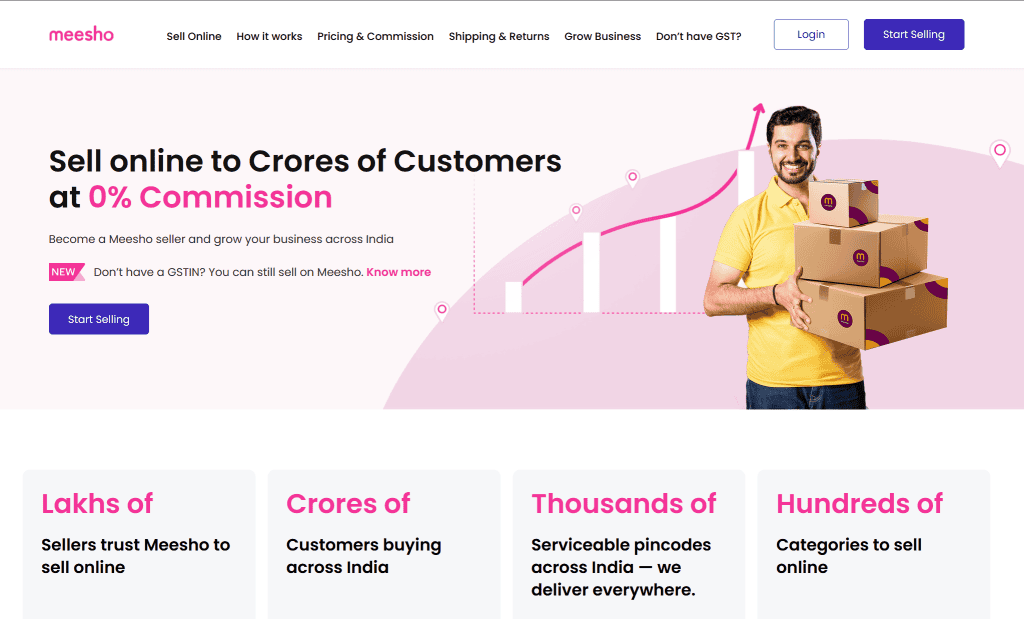

Meesho now follows a zero-commission model for sellers across all product categories, aiming to democratize e-commerce and support small businesses.

But here’s what’ll make you scratch your head: if Meesho isn’t charging commissions, how exactly are they making money? And more importantly, how did this approach help them capture millions of sellers and buyers in India’s competitive e-commerce landscape?

That’s exactly what we’re diving into. You’ll discover the mechanics behind Meesho’s unconventional revenue model and why its strategy might just be the future of social commerce.

What Is Meesho?

Meesho is India’s leading social commerce platform that’s completely changed how people buy and sell online. Think of it as the bridge between social media and e-commerce – where your WhatsApp groups, Facebook posts, and Instagram stories become your virtual storefront.

Founded in 2015 by Vidit Aatrey and Sanjeev Barnwal, Meesho started with a simple but powerful idea: let anyone become an entrepreneur without needing inventory, investment, or technical skills. The name itself is a clever blend of “meri” (my) and “shop” – literally meaning “my shop.”

Here’s how it works. Sellers list their products on Meesho’s platform. Then, resellers (mostly women looking to earn extra income) browse these products, add their markup, and share them across their social networks. When someone from their network buys, the reseller earns a commission without handling inventory or logistics.

What makes Meesho different from traditional e-commerce? It’s built around relationships and trust. Instead of browsing through endless product pages on a website, customers discover items through people they know and trust. Your friend recommends a beautiful saree, your neighbor shares a great deal on kitchen appliances, or your colleague posts about trendy accessories.

The platform has tapped into something uniquely Indian – the power of personal recommendations and social networks. According to Business of Apps, Meesho has over 150 million transacting users, making it one of India’s most successful social commerce experiments.

But Meesho isn’t just about social selling anymore. The company has evolved into a full-fledged e-commerce marketplace while keeping its social commerce roots. You can now shop directly on their app and website, just like any other online retailer, but with the added benefit of competitive prices and a focus on value-conscious shoppers.

Meesho’s Zero-Commission Business Model

While Amazon charges sellers 5-20% commission and Flipkart takes 2-20% depending on product categories, Meesho operates on a fundamentally different principle: zero commission on sales. This means when a seller lists a product for ₹100, they keep the entire ₹100 from the sale, minus any agreed-upon shipping costs.

The strategic reasoning behind this approach becomes clear when you consider India’s marketplace dynamics. Traditional e-commerce platforms essentially act as middlemen who extract value from each transaction. Meesho flipped this model by positioning itself as an enabler rather than an extractor.

For small businesses and micro-entrepreneurs, this difference is transformative. A local handicrafts seller who might lose ₹15-20 on every ₹100 sale on traditional platforms can maintain full control over their pricing and margins on Meesho. This pricing power is especially crucial for sellers operating on thin margins.

According to The Hindu Business Line, this zero-commission strategy has been central to Meesho’s ability to attract price-sensitive consumers and small-scale sellers who form the backbone of India’s informal economy.

The model works particularly well in India because it aligns with the country’s cost-conscious market behaviour. Small sellers can offer competitive prices without worrying about platform fees eating into their already modest profits.

How Does Meesho’s Operating Model Work?

The Three-Sided Marketplace Structure

Meesho operates as a three-sided marketplace where suppliers, resellers, and end customers form interconnected loops of commerce. Here’s how each side functions within this ecosystem.

Suppliers are manufacturers and wholesalers who list their products on Meesho’s platform. Think of a textile manufacturer in Tirupur or a handicrafts producer in Rajasthan uploading their inventory with wholesale pricing.

Resellers are individuals who browse these products, add their markup, and sell to their personal networks through WhatsApp, Facebook, or Instagram. A homemaker in Pune might discover trending kurtas on Meesho and share them in her neighborhood WhatsApp groups.

End customers purchase from these resellers, often without knowing about Meesho’s involvement. They simply see products shared by someone they trust in their social circle.

This structure creates a network effect where more suppliers attract more resellers, who then reach more customers. Each successful transaction strengthens all three connections, making the platform more valuable for every participant.

Social Commerce Integration

Here’s where Meesho’s model gets really clever. Instead of spending millions on Facebook ads or Google campaigns, they turned every reseller into a mini-influencer with built-in audiences.

The mechanics are surprisingly simple. When a reseller finds a product they want to sell, Meesho generates shareable links and product images optimised for WhatsApp, Instagram stories, and Facebook posts. A reseller might share a trendy kurti in their neighbourhood WhatsApp group or post ethnic wear collections on their Instagram.

But here’s the thing – people trust recommendations from friends and family way more than random ads. When your neighbour shares a beautiful saree she’s selling, you’re already 80% convinced because you’ve seen her taste in person.

The conversion rates tell the story. While typical e-commerce ads convert at 1-2%, social recommendations through personal networks often hit 15-20%. That’s because the “salesperson” isn’t a stranger – they’re someone who knows exactly what appeals to their circle and has genuine relationships with potential buyers.

Order Fulfilment and Logistics Process

When a customer places an order through a reseller’s WhatsApp or social media post, Meesho’s backend systems immediately spring into action. The order gets routed to the supplier, who then packages the product and hands it over to the logistics network.

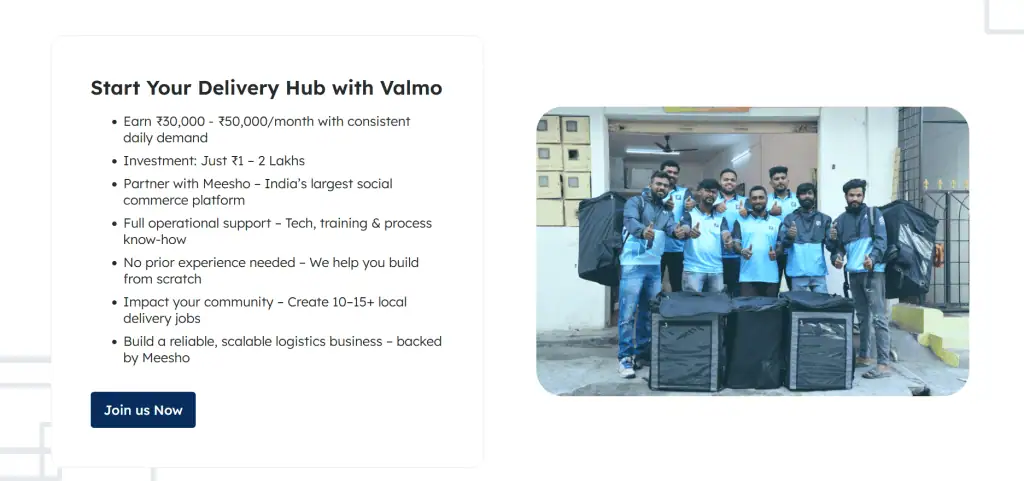

Here’s where things get interesting. Meesho doesn’t rely entirely on third-party delivery services like most e-commerce platforms. They’ve built their own logistics arm called Valmo, which now handles 50% of Meesho’s orders.

This hybrid approach means faster delivery times and better cost control. When Valmo handles an order, they can optimise routes specifically for Meesho’s customer base, which is heavily concentrated in smaller cities and towns. For the remaining orders, they partner with established logistics providers.

The entire process from order placement to delivery typically takes 3-7 days, depending on the location. What makes this different from traditional e-commerce is that the initial touchpoint happens through personal social networks rather than anonymous marketplace browsing.

Meesho’s Revenue Streams

Logistics Revenue Through Valmo

Here’s where Meesho’s business model gets interesting. While the platform doesn’t charge seller commissions, it found a different path to profitability through its logistics arm, Valmo.

Think of Valmo as Meesho’s internal delivery service that charges for shipping and fulfilment. Every time a seller ships a product through this network, Meesho collects logistics fees. The company essentially monetises the delivery process rather than the marketplace transaction itself.

The growth trajectory tells the story. Valmo started handling just 5% of Meesho’s shipments in its early days. According to Economic Times, this figure jumped from 30% to 70% of all shipments as the platform scaled. You might see different numbers elsewhere – some reports mention 50% – but that’s likely from different reporting periods as Valmo’s share keeps growing.

What makes this model smart is scale. As Meesho processes more orders, Valmo becomes more efficient. Route optimisation, bulk shipping discounts, and network density all reduce per-unit costs. Plus, keeping logistics in-house means Meesho controls the customer experience from purchase to doorstep.

This approach transforms a cost centre into a profit centre. Instead of paying third-party logistics companies, Meesho captures that margin while potentially offering competitive rates to sellers.

Meesho’s Revenue Generation: Beyond Zero Commission

While Meesho’s zero-commission model grabs headlines, the company has built a sophisticated revenue engine. The platform monetises primarily through advertising revenue from sellers who pay for promoted listings and enhanced visibility. Think of it like Google Ads for e-commerce – sellers bid for prime placement in search results and category pages.

Plus, Meesho generates revenue through brand partnerships and sponsored content. Established brands pay premium fees to feature their products prominently, targeting Meesho’s unique customer base of price-conscious shoppers in tier-2 and tier-3 cities.

Meesho’s Financial Performance

The zero-commission gamble is paying off. Meesho reached a GMV of $6.2 billion and grew its revenue from $403 million to $689 million, showing that alternative monetisation models can work in India’s price-sensitive market.

What’s impressive here isn’t just the growth – it’s the trajectory. While competitors burn cash on discounts and commissions, Meesho has found a way to scale sustainably by focusing on volume and advertising revenue.

Meesho’s Target Customers

Meesho’s customer strategy revolves around three core segments. First, women entrepreneurs who want to start small businesses without an inventory investment. These resellers use WhatsApp and Instagram to sell Meesho products to their networks, earning commissions without upfront costs.

Second, rural and semi-urban customers who prioritise value over speed. Unlike urban shoppers who want same-day delivery, Meesho’s customers are willing to wait 5-7 days for significantly lower prices.

Third, small manufacturers and suppliers who can’t afford Amazon’s or Flipkart’s commission structure. The zero-commission model democratizes e-commerce access for businesses operating on razor-thin margins.

Meesho’s Competitive Edge

Meesho’s competitive advantage lies in serving markets that Amazon and Flipkart largely ignore. While these giants focus on branded products and premium customers, Meesho thrives in unbranded, value-focused segments.

The zero-commission model creates a powerful differentiator. When Amazon charges 5-20% commission and Flipkart charges 2-20%, Meesho’s 0% commission gives sellers immediate cost advantages they can pass to price-sensitive customers.

This approach has allowed Meesho to achieve profitability while its larger competitors still burn cash trying to win market share through discounting.

The Sustainability Question

But here’s the challenge that keeps investors awake at night: can the zero-commission model sustain long-term growth? Critics argue that without commission revenue, Meesho’s advertising income alone may not support the infrastructure costs of serving millions of small-ticket transactions.

The company faces pressure to eventually introduce some commission structure, especially as it scales. The question isn’t whether Meesho can grow – it’s whether it can maintain profitability while preserving the zero-commission promise that defines its brand.

That tension between growth and sustainability will ultimately determine whether Meesho’s business model can truly disrupt India’s e-commerce landscape or if it’s simply a stepping stone to a more traditional revenue structure.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.