Be it taxis, hotels, groceries, food, or travel, the aggregator business model has entered into and has disrupted every industry.

This model (also called the on-demand delivery model or Uber for X model) involves organising an unorganised and populated sector like hotels and taxis and providing the service under one brand.

What Is Aggregator Business Model?

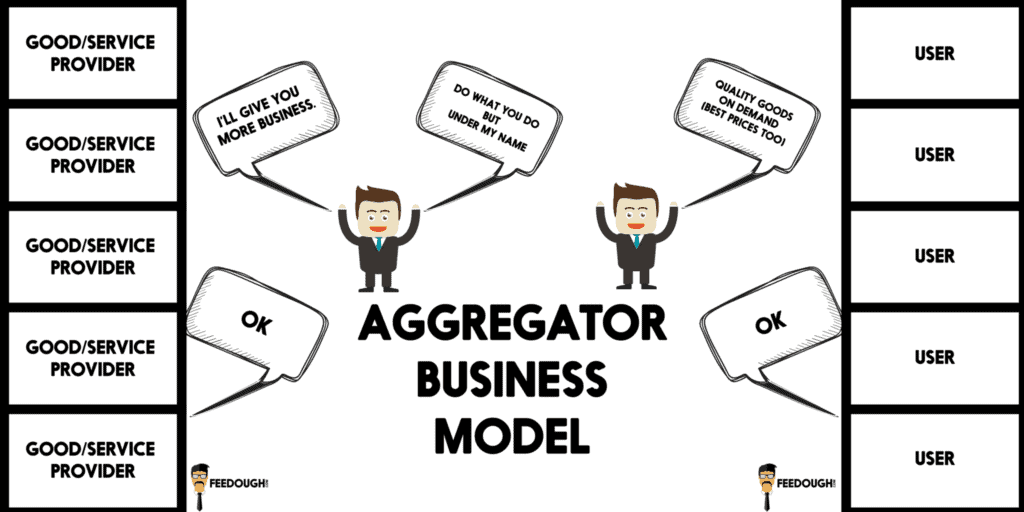

Aggregator Business Model is a network model where the aggregator firm collects information about particular offering providers, sign contracts with such providers, and sell their services under its own brand.

Since the aggregator is a brand, it provides an offering that has uniform quality and price, even though it is offered by different partner providers.

The offering providers never become aggregator’s employees and continue to be the owners of the product or service provided. Aggregator just helps them in marketing in a unique win-win manner.

How Aggregators Operate?

Even though aggregators belong to the two-sided marketplaces, they operate differently from a marketplace business model that powers the business of Amazon, eBay, etc.

How Does Aggregator Business Model Work?

Theoretical explanation of this model is simple:

- Aggregator visits the offering providers.

- Aggregator promises them more customers and proposes a partnership plan.

- Service providers are now the partners.

- Aggregator builds up his own brand and tries to attract customers through many marketing strategies.

- Customers make purchases through the aggregator.

- Partners get the customers as promised.

- Aggregator gets the commission.

Partnership Model

The offering providers are not the employees of the aggregator. They act as partners to the business. Partners always have the freedom to accept or to reject the offer provided by the aggregator (these terms are clarified in the contract).

Customers

The offering buyers form the target customers of aggregators.

But, the aggregator business model runs on a two-fold customer strategy where the business has to cater to not only its offering’s consumers but also has to treat its partners as another set of customers. This is because partners also have a choice to choose the competitors over the company.

Hence, the company builds its brand in such a way so as to attract both of the parties to use this platform and develop a network effect.

Industry

All the offering providers belong to the same industry.

The Aggregator collects the offering providers of a single industry and organises them under its own brand. Like Airbnb for Hotels, Uber for taxis, Oyo for hotel rooms, etc

Brand

Aggregators spend most of their revenue on building up a brand. This brand has certain notable features like – quality, price band, on-demand delivery, etc. All the goods/services are provided under a single brand but by different providers.

Branding is done at every customer touchpoint to have a recall value.

Quality

The aggregator strives to provide a standardised quality to every user. It usually has quality assurance teams that make sure quality is maintained.

Contract

A contract is signed between the aggregator and the goods/service provider with all the partnership and commission terms. The terms provide a win-win situation for both the parties where the partners focus on providing quality product/service to the customers and the aggregator focus on marketing and creating more leads for the partners.

Terms usually include

- Branding terms,

- The standardised quality required by the aggregator,

- Commission terms (Uber Business model) or take-up rate terms (Oyo Business model)

- Other terms depending on the industry and the aggregator involved

Pricing

Aggregators are different from a marketplace (like Amazon, Alibaba, Flipkart, etc.). They have the liberty to provide offerings for standardised prices or price bands, and some can even set their own price. For example, Uber has a definite price per kilometre and Oyo sets its own price using the take-up rate pricing strategy.

Competition

Competition in the aggregator business model is tough to handle as the same partners might work for competitors as well.

Aggregator Revenue Model

The offerings providers play a vital role in the aggregators’ revenue model –

- Aggregators provide them with the customers and in return charge some commission. (Uber Business Model), or

- The partners quote the minimum price at which they’ll operate and the aggregators, after adding up the take-up rate, quote the final price to the consumer. (Oyo Business Model)

This method isn’t always in operation. The revenue generation is different for different business stages, cycles, and seasons. There is a big role of discounts and dynamic pricing in determining the total revenue generation by aggregators.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of this article on the Aggregator model in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.