Ever wondered why no competitor could come close to Facebook even when Google spent billions to make users try its Google+?

Or why the majority of the users didn’t (or couldn’t) leave Whatsapp even after the big controversy relating to its privacy policy?

The answer lies in a phenomenon called network effect.

Network effects are why you will not (or can not) wake up one day and decide to leave behind all your contacts on Whatsapp and switch to Signal. These platforms are designed in such a way that it becomes tough for any competitor to overpower them even after spending millions.

Curious?

Dive in to find out more about network effects and how you can build one yourself!

What is The Network Effect?

In the words of Harvard Business School professor Bharat Anand, “the term network effect refers to any situation in which the value of a product, service, or platform depends on the number of buyers, sellers, or users who leverage it. Typically, the greater the number of buyers, sellers, or users, the greater the network effect—and the greater the value created by the offering.”

In simpler terms, an offering that capitalises on network effect becomes more valuable when more people use it.

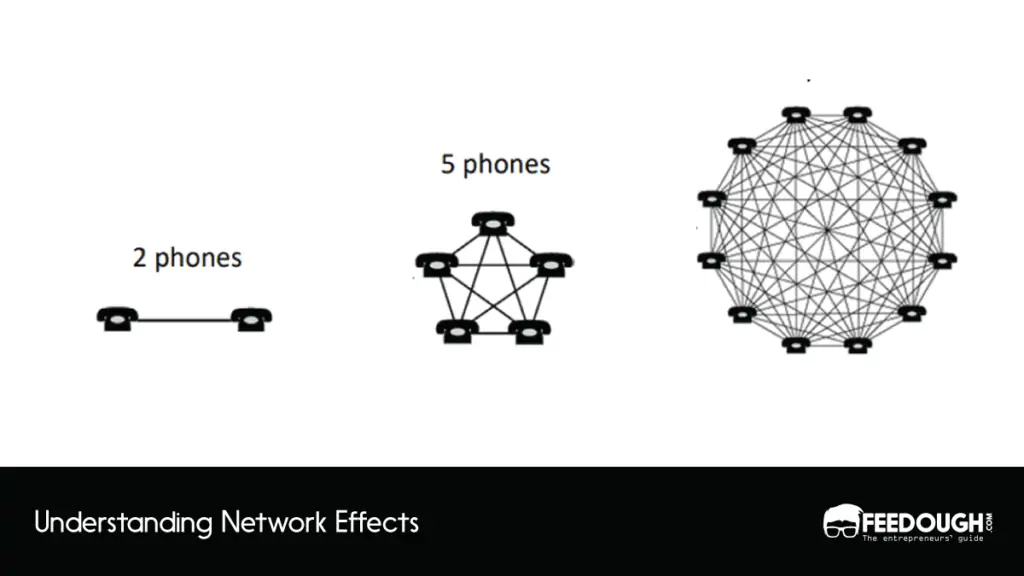

It is a phenomenon that dictates that the increase in the usage of a product, service, or experience increases its value for every other user. The term first emerged when researchers began to study the development of telephone networks.

Let’s explain the power of the network effect using a simple example. Suppose you are the only one who owns a telephone in the world. Now, this device would be utterly useless to you if you’re the only one. But, if your friend also owns a telephone, there’s some utility to it as you can now communicate with your friend. Now, what if four of your friends own a telephone? There can be 10 interactions in all! Notice the drastic increase in your perceived value of the application as more and more of your friends join the network. This increase in value further induces more people to own it and grow the network.

This is the power of the network effect!

Network effects are the primary source of competitive advantage and play a crucial role in the retention of consumers and the platform’s growth. For example, you wouldn’t leave Facebook and switch to another platform that your friends or family don’t use yet. Similarly, it’s hard for you to switch from Whatsapp to Telegram and Signal because not all of your contacts will switch to the same. Hence, even though many users downloaded Signal and Telegram after the WhatsApp controversy, not many could delete WhatsApp completely.

But, network effects are not always positive. They don’t always increase the value of a product or service. Network effects can be negative too.

For example, assume you have an account on Facebook. You chat with your friends or colleagues, comment on their posts and post your pictures. But then, due to network effects, all of your relatives and family members join in too. This increase in unwanted users would presumably reduce the value of the platform for some people. And this is one of the main reasons why most teens switched over to Instagram.

How Network Effects Result In Market Dominance?

In the last two decades, network effects have accounted for 70% of the value creation in digital startups. It isn’t surprising as the power of network effects is massive. Once a network is harnessed into a platform or a startup, unlimited growth potential can be unleashed. The following points reiterate the importance of network effects for a platform and answer why you should consider integrating network effects into your platform or marketplace.

Network Effects Increase The Value A Platform Provides

When network effects are strong, the value of your platform increases sharply with each additional user.

Take Instagram, for example. As the number of users of Instagram increases, it becomes more attractive and valuable for existing and new users. This, in turn, increases the amount and variety of new content on Instagram, attracting even more users.

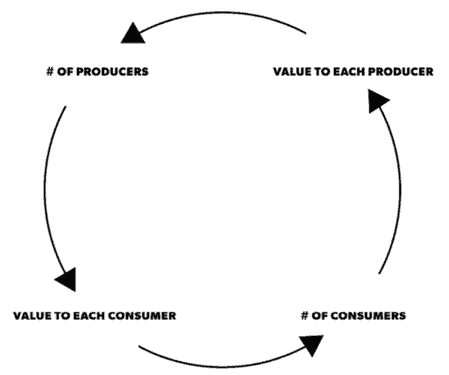

A Platform With Network Effect Requires Comparatively Less Marketing

Once you establish a network effect, it capitalises on network automation. It eventually grows and markets itself as more and more users join in. For example, if numerous developers develop apps on Playstore, more consumers will be attracted to the platform and will eventually prefer Android over other smartphones. It, in turn, will induce even more developers to learn and develop such apps. And the loop will go on.

This positive feedback loop forms the core of network effects.

If your platform or company already has a network effect in place, it can grow with comparatively much less marketing or without trying to attract more customers.

But the marketing executives can’t sit back and relax, thinking that the network effect will do their job. They need to make sure that the network’s needs and wants are fulfilled as and when they arise.

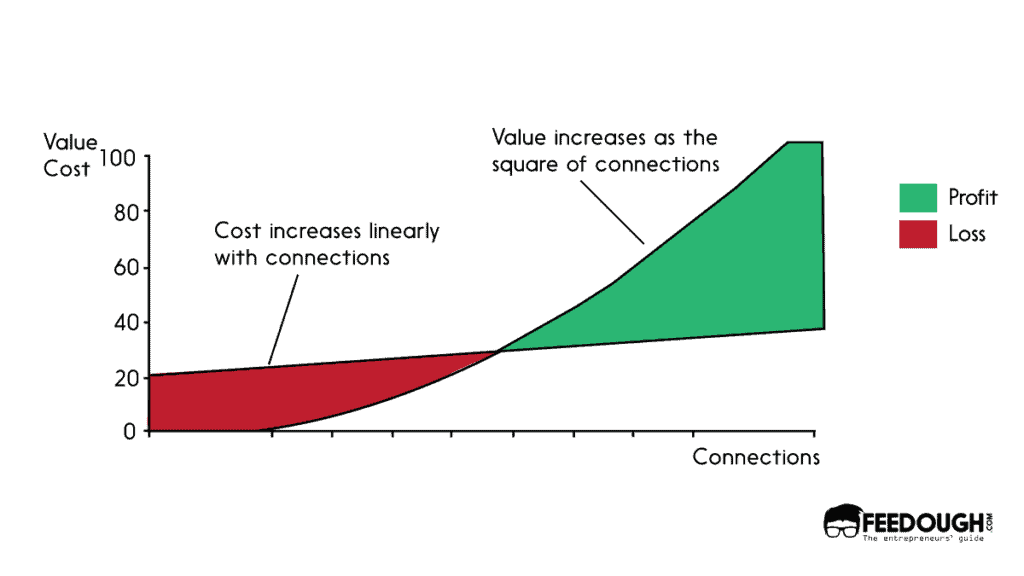

Network Effect Maintainance Cost Is Lesser Than The Value It Adds

Yet another advantage of having a network effect in place is that the value generated through the effect is much more than what it costs you to maintain it. While the value of the platform increases exponentially, the cost of each additional user will increase linearly. This is because you do not buy more assets to grow the platform. Instead, you acquire more customers, and that automatically helps your platform to thrive.

Network Effects Often Result In Market Monopoly

All these features of network effects tend to strengthen the platform and make it invincible. Now any competing platform will have to probably spend millions or even billions on building such a network. This is why it is often said that network effects monopolise a market where usually the winner takes all.

Types of Network effects

A network effect can be built in numerous ways, and its dynamics change depending on its type. It is essential to understand these different types of network effects to realise their potential correctly.

Same-Side Network Effects

Also referred to as the direct network effect, this is the simplest of all network effects. It dictates that an increase in the number of users increases the value of the product.

For example, if you were to create an instant messaging platform like Whatsapp, you would be integrating direct network effects.

Cross-Side Network Effects

Also known as the indirect network effect, it dictates that the value of a product or service increases due to the complementary products or services that add value to the original platform.

An example of indirect network effects is Microsoft Windows. Imagine you are a user of Microsoft Windows. As you increase the usage of Windows, you also increase the value of applications on this Operating System. Now, more developers would be willing to build and develop such applications. And this, in turn, would increase the value of Microsoft Windows for you.

Two-Sided Network Effects

These network effects can be seen as a two-directional version of indirect network effects. It dictates that the value of a service or a product increases for one user group when a user from a different user group joins the network.

For example, eBay has two user groups: the sellers and the buyers. Now suppose you are a buyer on eBay. Then an additional buyer will not provide any value to you. But an additional seller will enhance your experience on eBay as now you will have more options to choose from.

Local network effects

A local network effect is a phenomenon where each user is influenced by only a small subset of other users.

Uber is an example of local network effects. Suppose you are an Uber driver working in New York, then you would be influenced only by the New York network and not by the network existing in any other state.

Companies That Capitalised On The Power Of Network Effects

With the advent of the internet, network effects have become even more powerful and engaging. Almost all the top-ranking tech companies with their market capitalisation touching billions of dollars use network effects to grow their platforms further and increase their reach. Some examples of such companies include:

Facebook started as a simple social networking service to connect Harvard university students. But today, you would hardly come across someone who doesn’t have a Facebook account. Facebook has become an indispensable part of people’s lives, and probably yours too. Having a Facebook account has become as common as having your email. And it sounds absurd when someone says that they don’t use the platform.

But what makes Facebook so special is that the platform provides you with the ability to connect with your friends, family, and acquaintances. Facebook operates on a personal direct network effect. It taps into your fear of missing out and induces you to become a part of a network that becomes more valuable as more and more people join.

Also, while scrolling Facebook, you must have seen some sponsored advertisements, which are very spookily based on your preferences and online behaviour. These advertisements are a part of Facebook’s self-serve ad platform, giving the company access to two-sided network effects. The users and advertisers are a part of a cross-side network whose value increases with each additional user.

The company overpowered all its competitors and is still at the top because of its intricate network effects.

Uber

Uber has become synonymous with a cab ride today.

Notice how we say calling an ‘Uber’ and not a ‘cab’. That is the impact Uber has on our lives. All thanks to the network effect.

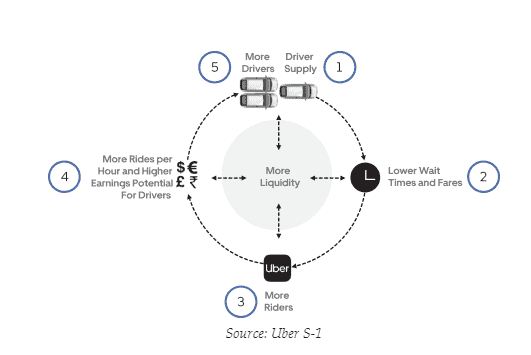

Uber has seen tremendous growth in past years and currently has a market capitalisation of $97.11 billion. The company’s greatest asset is its massive network and integrated network effects.

The company operates on a cross-side network effect, with users on one side and the drivers on the other side.

The said network effect works in 5 stages. As the number of drivers increases, the potential wait time and fares decrease for users. This induces more customers to join Uber’s network, which increases earning potential for drivers and completes the loop.

Amazon

Amazon has become the one-stop destination for everyone’s shopping needs. Whether you are a consumer or a producer, Amazon is the place to go whenever you need to buy or sell anything.

The company has a present market capitalisation of $117 trillion. It has been possible because the platform has successfully unleashed the true power of network effects. This eCommerce giant operates on a two-sided marketplace business model, capitalising on a cross-side network effect.

The two sides of the network include the sellers and the buyers. Now, as the number of sellers increases, the marketplace offers more choices to the customers, and thus the number of buyers increases. This, in turn, induces even more sellers to sell on Amazon.

The two sides feed each other, which automatically grows Amazon’s user base and its value to every user.

These strategies, along with a social validation system and a recommendation system, have helped Amazon scale and impact its millions of consumers.

How To Build and Develop Network Effects?

It is challenging to overpower a platform with existing network effects but developing one is also not a child’s play. It requires effort, research, and experimentation to create and nurture a network effect. With that said, there are many strategies with which companies can try to create a network effect. Some of these strategies are listed below:

Product First Model

Creating a network effect and establishing a user base can be a daunting task. How would you attract the first user with a network effect unless there is a network?

The answer here is to attract users by providing them value and then getting them to participate in a network. Although this isn’t the only way to build a network, the strategy can be beneficial for companies trying to build a platform with network effects. For example, Quora’s founders started off the network by posting questions themselves and even answering them. This questions-answers loop was continued till the product was ready to be marketed to the right audience. Then the founders capitalised on the right marketing channels to promote the product.

Subsidisation

Two-sided platforms like Amazon and Uber often face the chicken and egg problem while developing a network. The problem entails deciding which of the two sides the platform should attract first.

How would you attract sellers if there are no buyers on your platform, and how would you attract buyers when there is no product to sell?

A strategy that can be used here is to subsidise one of the two sides. For example, Adobe tried to launch readers and writers together. But no one was willing to buy a reader when there was no content. Similarly, no one wanted to buy a writer and generate content when there were no readers.

So, Adobe broke the impasse by subsidising one side and giving away readers for free.

Content First Model

In this strategy, instead of connecting users with each other, the platform tries to provide them with tools to generate content and then subsequently connect with each other.

This model gives the user an immediate value and attracts them to participate in a network.

For example, Instagram allows you to make reels, and Youtube allows you to generate videos. Many such platforms like Pinterest, Quora and Dribble have tried to create content before engaging users in a social network.

Network Bridging

Another growth strategy for a platform could be network bridging. This strategy entails connecting different networks. A platform can leverage its multiple users and their corresponding data to diversify into different networks and improve its economics.

An interesting example here could be Alibaba.

The e-commerce giant bridged its Taobao and Tmall with its payment service Alipay. This way, Alibaba provided the buyers and sellers with a much-needed service and simultaneously built trust between them. Both these networks reinforced each other’s market positions and provided added value to the consumers.

That is why even when the rival platform Tencent offered the wallet service called WeChat pay, Alipay didn’t lose its consumers as the service was more attractive due to its bridging with Alibaba.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of this article on power of network effects in the comments section.

An enthusiastic human being with determination and zeal to explore new ventures. Tanya is an entrepreneurial spirit searching for changes and learning to exploit them as opportunities and impacting people for good.